Southwest Title and Escrow Your Trusted Partner for Real Estate Closings

Buying or selling property can be one of the most exciting yet stressful experiences in your life. Between paperwork, title verifications, escrow funds, and legal procedures, the process can quickly become overwhelming. That’s where Southwest Title and Escrow, Inc. comes in as a trusted local provider ensuring that your real estate closing runs smoothly, securely, and without surprises.

Headquartered in Santa Fe, New Mexico, Southwest Title and Escrow (often abbreviated as SWT&E) offers full-service support for buyers, sellers, and lenders. Let’s dive into what this company does, what benefits it offers, and why you might want to work with them for your next property transaction.

What Is Title and Escrow in Real Estate

Understanding “Title”

The “title” in real estate represents the legal ownership of a property. It defines who has the right to use, sell, or lease that property. Before a property sale is completed, a title company like Southwest Title and Escrow performs a title search to verify that the property is free from liens, unpaid taxes, ownership disputes, or clerical errors.

Without a proper title search, a buyer might unknowingly purchase property that has hidden claims or debts attached, and that could lead to major legal trouble later.

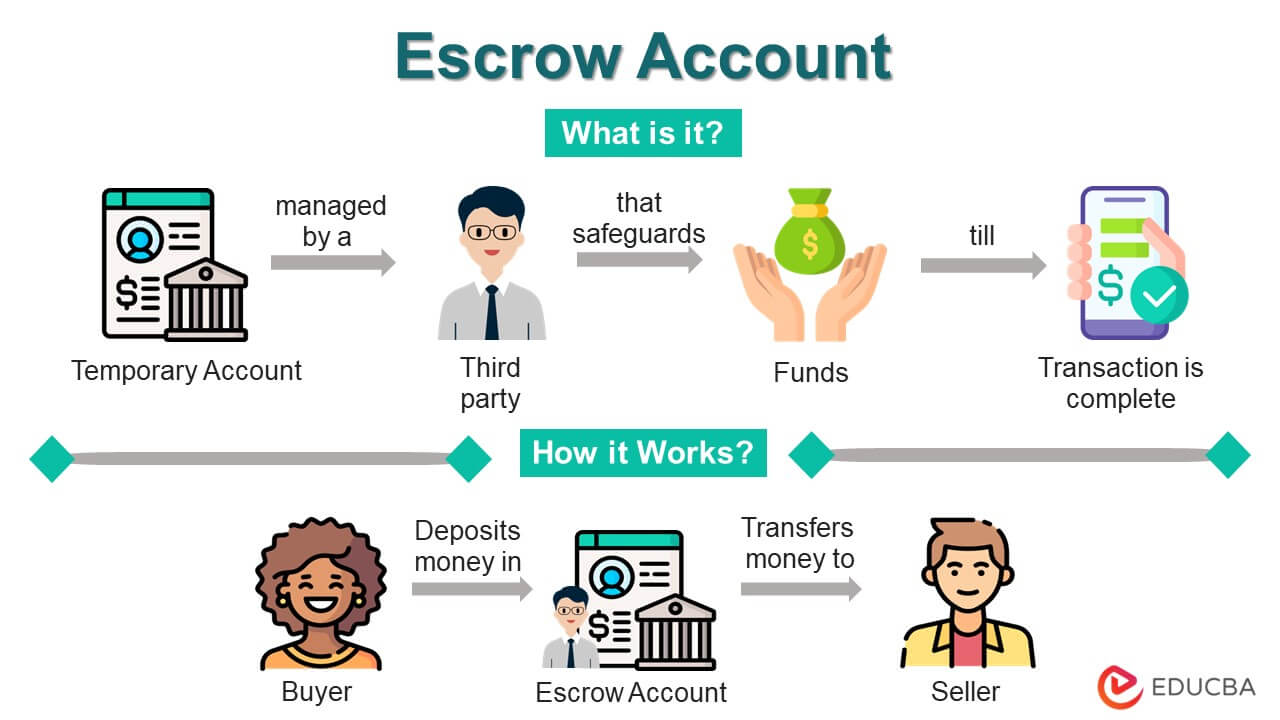

Understanding “Escrow”

An escrow is a neutral third-party account that temporarily holds funds and documents until all terms of the real estate contract are met. The escrow company ensures that both parties fulfill their obligations before money and ownership officially change hands.

In simpler term,: escrow protects both the buyer and seller from financial risk. The buyer’s funds are only released once all contractual steps are complete, and the seller can rest assured they will get paid once everything is verified.

Why Both Matter

Title and escrow are two sides of the same transaction coin.

-

The title ensures the property’s ownership is clean and transferable.

-

Escrow ensures that the exchange of money and property happens fairly and securely.

A professional company like Southwest Title and Escrow manages both, making sure your transaction stays compliant, organized, and stress-free.

Why Choose Southwest Title and Escrow

Company Overview

Southwest Title and Escrow, Inc. has been a cornerstone in New Mexico’s real estate industry for over two decades. With offices in Santa Fe, Española, and Albuquerque, the company offers local expertise backed by partnerships with major national underwriters.

Their team consists of experienced escrow officers, title specialists, and closing coordinators who handle every detail from the first title search to the final signature at closing.

What Makes Them Stand Out

-

Local Expertise – They understand New Mexico’s real estate laws, regional nuances, and county recording systems.

-

Major Underwriter Partnerships – Though locally owned, SWT&E works with top underwriters to ensure security and reliability in every title insurance policy.

-

Customer-First Focus – Clear communication and transparency are core to their service. Clients are kept informed every step of the way.

-

Efficient Closings – Their process minimizes errors and delays, ensuring a timely closing experience for all parties involved.

Why It Matters

A real estate deal is one of the biggest financial transactions you’ll ever make. Having a knowledgeable, professional company like Southwest Title and Escrow involved helps reduce risk, save time, and ensure your investment is fully protected.

Southwest Title and Escrow’s Core Services

Let’s explore the five primary services Southwest Title and Escrow provide,s each acting as a “product” that plays a vital role in a successful real estate transaction.

1. Title Search

Before any property sale, SWT&E performs a comprehensive title search. This involves examining public records to confirm legal ownership and identify any encumbrances like liens, easements, unpaid mortgages, or judgment claims.

Problem Solved:

Many buyers assume the seller has a clear tit,le but even small clerical errors or undisclosed heirs can jeopardize ownership.

Benefit:

SWT&E’s experienced title officers ensure you get a clean, transferable title, giving you peace of mind that the property truly belongs to you.

How to Use It:

Contact the company through their official website and provide the property address. Their team will prepare a detailed title report before your closing.

Request Title Search

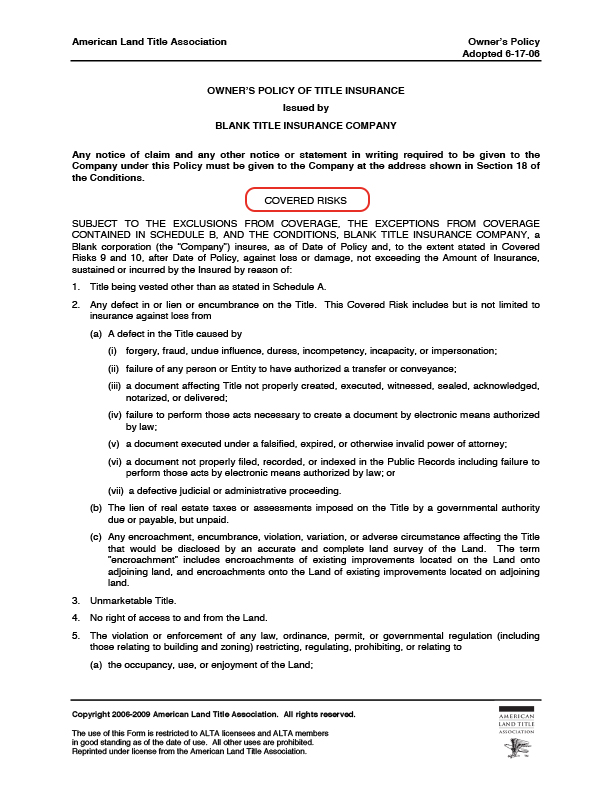

2. Title Insurance

Once a title search is complete, the next step is obtaining title insurance. This one-time premium protects buyers and lenders against future legal challenges or ownership claims that may arise after closing.

Problem Solved:

Even with the best title search, human or historical errors can surface la,,ter a missing heir, a misfiled deed, or an undisclosed lien.

Benefit:

Title insurance ensures that, if such issues occur, you are financially protected. The insurance company covers legal fees and potential losses.

How to Get It:

SWT&E partners with reputable underwriters to provide both Owner’s and Lender’s title insurance policies.

Get Title Insurance

3. Escrow Services

Escrow services form the bridge between the buyer’s payment and the seller’s property handover. SWT&E acts as the neutral intermediary that safeguards both parties’ interests.

Problem Solved:

Without a reliable escrow agent, either party could face premature payment releases or incomplete document,ation leading to disputes and lost funds.

Benefit:

SWT&E guarantees that funds are disbursed only after all conditions are fulfilled, including inspections, loan approvals, and title clearance.

How to Use It:

When signing your purchase agreement, name Southwest Title and Escrow as your escrow agent. They’ll provide instructions for depositing funds and documents.

Use Escrow Services

4. Real Estate Closing Coordination

The closing marks the finish line of your real estate j,ourney where contracts are signed, funds are exchanged, and the title officially transfers.

Problem Solved:

Disorganized closings can lead to missed deadlines, legal delays, or even failed transactions.

Benefit:

SWT&E coordinates every element of closing: verifying funds, preparing final statements, organizing signatures, and filing with the county recorder.

How to Use It:

When you’re ready to close, contact SWT&E to schedule the date and provide final lender documents. They’ll handle the rest.

Schedule Your Closing

5. Title & Escrow Advisory

Sometimes, real estate transactions aren’t straightforward. You might encounter complex ownership issues, inheritance disputes, or delayed lender approvals.

Problem Solved:

Without expert guidance, these complications can postpone or even terminate a sale.

Benefit:

SWT&E’s advisory services identify potential red flags early and guide you through the proper legal or administrative steps to fix them — long before they affect your closing date.

How to Use It:

Contact their advisory department before signing any agreement to review your title or escrow concerns.

Book a Consultation

Key Benefits of Using Southwest Title and Escrow

Financial and Legal Security

SWT&E’s process ensures your property purchase is legally sound. Their due diligence eliminates hidden claims and secures your ownership. With title insurance in place, your investment remains protected even years after closing.

Streamlined Transactions

Instead of juggling between lawyers, lenders, and real estate agents, Southwest Title and Escrow handles it all under one roof saving you time and reducing confusion.

Local Expertise, Global Standards

Being a New Mexico-based company gives SWT&E an advantage in understanding local county systems, legal requirements, and land historysomething national chains often lack.

Transparency and Communication

Clients receive continuous updates throughout the process from title research to closing day. No guessing games, no last-minute surprises.

Real-World Use Cases: Who Needs These Services the Most

First-Time Homebuyers

If you’re buying your first home, you may not know how complex ownership verification can be. A title or escrow mistake could cost you thousands. Southwest Title and Escrow ensures you buy a property with a clean title and handles your funds safely through escrow.

Real Estate Investors

Investors purchasing multiple properties or fix-and-flip homes benefit from SWT&E’s efficiency. Their fast processing and deep local knowledge help investors close deals quickly avoiding costly delays and protecting future resale value.

Sellers Seeking a Smooth Transaction

Sellers can also benefit. By agreeing to work with a trusted title and escrow company, sellers prevent potential disputes or misunderstandings during the transfer. This speeds up closing and builds buyer confidence.

How to Purchase and Use Southwest Title and Escrow Services

Step-by-Step Guide

-

Visit the official website at

-

Choose the service you need title search, title insurance, escrow, or full closing.

-

Submit your property details and transaction type (buying or selling).

-

Receive a service quote and estimated completion timeline.

-

Sign the service agreement and deposit initial documents or funds.

-

SWT&E will perform the title search, open escrow, and coordinate with all parties.

-

Attend the closing appointment to finalize the transfer.

-

Receive your recorded deed and final title insurance policy after completion.

Pro Tips

-

Always select a local title and escrow company when possible; they understand state-specific regulations better.

-

Communicate early with your agent and lender that you’re using SWT&E.

-

Request a written fee breakdown and timeline to avoid hidden costs.

-

Keep copies of all closing documents for your records.

Frequently Asked Questions

1. Do I need both title and escrow services for my property purchase?

Yes. Title services verify that the property ownership is legitimate and transferable, while escrow ensures that funds and documents are exchanged safely. Both protect you from fraud, financial loss, and legal issues.

2. How much do Southwest Title and Escrow services cost?

Costs vary based on property value and service type. Generally, buyers and sellers share title and escrow fees, but this can differ depending on local customs. You can request a personalized estimate directly from SWT&E before your transaction.

3. Can I choose Southwest Title and Escrow if my agent recommends someone else?

Absolutely. As a buyer or seller, you have the right to select your title and escrow company. Choosing SWT&E ensures that you work with experienced professionals who prioritize security, accuracy, and transparency.