No Appraisal HELOC – Fast Home Equity Access Without Traditional Valuation

When homeowners need quick access to cash for home renovation, debt consolidation, or emergency expenses, a Home Equity Line of Credit (HELOC) often becomes the go-to option. But there’s a faster, smarter version of it: the No-Appraisal HELOC.

In this guide, we’ll break down everything you need to know about what it is, how it works, its benefits, real-world examples, and where to get one. Let’s dive in.

What Is a No-Appraisal HELOC

A no-appraisal HELOC is a type of home equity line of credit that lets you borrow against your home’s equity without undergoing a traditional full appraisal.

Instead of sending an appraiser to inspect your property, lenders use Automated Valuation Models (AVMs), tax records, or recent appraisals to estimate your home’s current value.

According to Figure.com, modern lenders can approve HELOCs without a full appraisal using technology-driven valuation models. This drastically speeds up approval, sometimes in just a few days.

How It Works and What You Need

Here’s how the process typically goes:

-

The lender uses AVM or public data to estimate your property value.

-

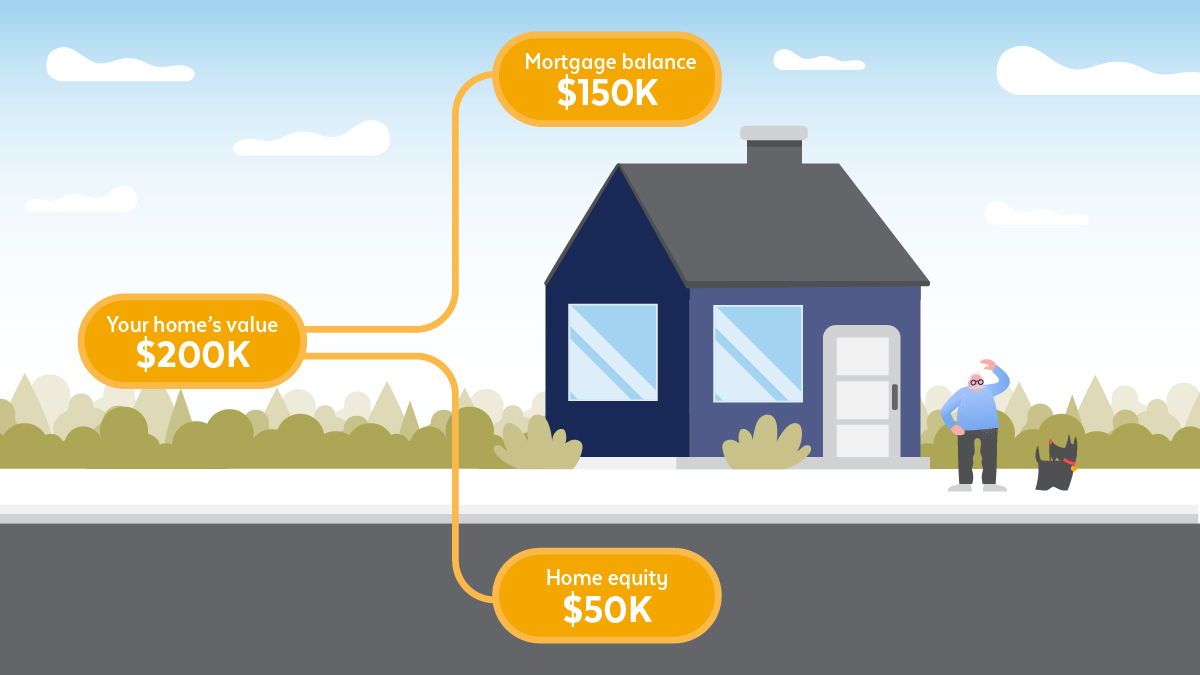

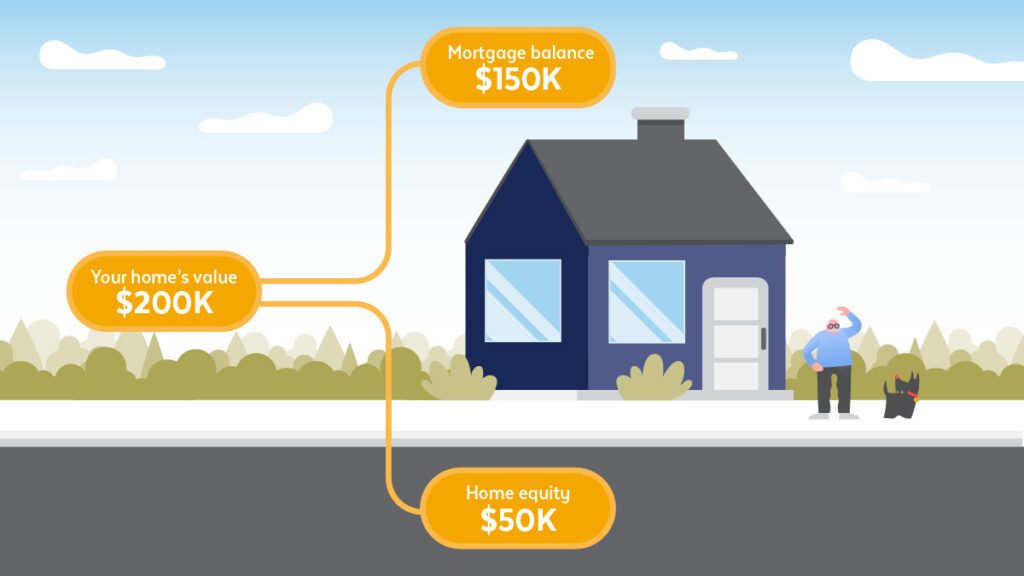

Your home equity is calculated: estimated home value minus existing mortgage balance.

-

The credit limit is set based on the loan-to-value (LTV) ratio and your financial strength.

-

You get access to a revolving line of credit, similar to a credit card you only pay interest on what you borrow.

Because there’s no in-person appraisal, lenders often require:

-

High credit score (700+)

-

Strong home equity (20–30%)

-

Low debt-to-income (DTI) ratio

Some lenders allow no-appraisal HELOCs only if your home was appraised recently or if the requested loan amount is below a certain threshold.

Key Benefits of a No-Appraisal HELOC

-

Faster Approval Time

Traditional appraisals can take a week or more. No-appraisal HELOCs eliminate this bottleneck, letting you get funds in as little as 3–5 business days.

Ideal for emergency repairs, tuition payments, or time-sensitive opportunities. -

Lower Upfront Costs

Appraisals can cost several hundred dollars. Skipping this step means you save money immediately. -

100% Online Process

Many lenders offering no-appraisal HELOCs are digital-first; everything from application to approval can be done online.

For instance, Griffin Funding allows you to apply digitally and receive funds within days. -

Flexible Use of Funds

Like any HELOC, you can draw funds as needed for home improvements, debt consolidation, or personal expenses — and pay interest only on what you use.

Real-World Examples of No-Appraisal HELOC Providers

1. Figure – No-Appraisal HELOC

Details:

Figure uses Automated Valuation Models (AVM) instead of physical appraisals. They specialize in fast approvals and digital verification.

Use Case:

Perfect for homeowners with solid equity and excellent credit scores who want quick access to funds.

Pros: Fast processing, competitive rates, no appraiser visits.

Cons: May offer smaller credit limits for older or unique properties.

2. Griffin Funding – Digital HELOC (No Appraisal Required)

Details:

Griffin offers a fixed-rate digital HELOC that doesn’t require a full appraisal. They use a Property Condition Report (PCR) and AVM technology for valuation.

Use Case:

Homeowners who need large amounts quickly and want an entirely online experience.

Pros: Fast funding (3–5 days), fixed rates.

Cons: Only available in certain U.S. states.

3. Better.com – HELOC with Appraisal Waiver Option

Details:

Better.com provides streamlined HELOC options where some borrowers may qualify for an appraisal waiver, depending on property type and equity.

Use Case:

For those who have already financed through Better.com or recently had their home appraised.

Pros: Trusted fintech lender, modern platform.

Cons: Availability of the waiver varies by borrower profile.

Why and When You Should Choose a No-Appraisal HELOC

Problems It Solves

-

You have urgent financial needs and can’t wait for a full appraisal process.

-

You need quick renovation funds (roof damage, plumbing, etc.).

-

You want to consolidate high-interest debts fast.

-

You live in an area where automated valuations are accurate and property prices are stable.

Why It’s Better Than Traditional HELOCs

-

Speed: Faster approval and funding.

-

Cost: Saves you appraisal fees.

-

Convenience: Entirely digital and paperless.

-

Flexibility: Withdraw funds as needed, no lump-sum restrictions.

Risks and Considerations

-

Higher Interest Rates: Some lenders charge a bit more to offset risk.

-

Lower Credit Limits: AVM valuations can be conservative, reducing borrowing power.

-

Limited Availability: Not all lenders offer no-appraisal options nationwide.

-

Equity Sensitivity: Works best for homeowners with high equity and strong credit.

How to Apply and Where to Get a No-Appraisal HELOC

Steps to Apply

-

Estimate Your Home Equity – Use online valuation tools or property data.

-

Check Credit Score – Ensure your FICO score is 700+.

-

Compare Lenders – Look for those that specifically advertise “no-appraisal HELOC” or “digital HELOC.”

-

Apply Online – Upload documents like income proof, mortgage balance, and property details.

-

Review and Sign – Once approved, you can access your funds online.

Where to Apply (with Direct Links)

If publishing this article on a website, you can format the links as buttons:

→ Apply Now at Figure

→ Apply Now at Griffin Funding

→ Apply Now at Better.com

Expert Tips

-

Even without an appraisal, keep your home in good condition, and lenders may request photos or property data.

-

Only borrow what you need to avoid unnecessary interest.

-

Track how you use the funds; using them for upgrades can increase your property value.

-

Review draw periods and repayment terms carefully.

Conclusion

A No-Appraisal HELOC is the fast lane to home equity access. If you have strong credit, solid equity, and want funds quickly, it’s a powerful option.

It saves time, cuts costs, and lets you borrow without the hassle of appraisers visiting your home. However, you should weigh potential trade-offs: slightly higher rates, smaller limits, and limited availability. Used wisely, this product can help you unlock your home’s potential quickly and securely.

FAQ

Q1: Does “no appraisal” mean no valuation at all?

No. Lenders still estimate your home’s value using automated tools like AVMs or Property Condition Reports. It just skips the physical inspection.

Q2: Are interest rates higher for no-appraisal HELOCs?

Often yes, but not always. Some lenders may increase rates slightly to offset risk. Others maintain competitive rates if your credit and equity are strong.

Q3: Who is this product best suited for?

It’s ideal for homeowners with substantial equity, excellent credit, and urgent financial needs who don’t want to wait for a traditional appraisal.