Home Equity No Appraisal – Unlock Your Home’s Value Without a Traditional Appraisal

Accessing the equity in your home can be a powerful way to fund renovations, pay off high-interest debt, or seize an investment opportunity. One increasingly popular route is the home equity no appraisal option, meaning you tap into your home’s value without enduring the full, traditional property appraisal process. In this article, we’ll walk through how this works, the benefits and trade-offs, real-world lender products that offer such options, how to apply, use cases, and FAQs to help you decide if this path fits you.

What Does Home Equity No Appraisal Mean

The phrase “home equity no appraisal” refers to a home equity loan or line of credit (HELOC) where the lender does not require a full in-person appraisal of the property to determine value. Instead, the lender may rely on alternative valuation methods such as automated valuation models (AVMs), desktop reviews, tax assessment data, or even a recently completed appraisal that still meets their criteria.

Why does this matter? A traditional appraisal can mean scheduling an inspector, having someone visit your home, waiting for the report, and then closing the loan. That can add time and cost. With the “no appraisal” option, you may avoid or reduce those steps, potentially saving money and receiving funds faster.

This doesn’t mean the lender is ignoring your home’s value; they still must estimate how much equity you have, so they know how much you can borrow and the risk they’re assuming. They’re just using a streamlined method rather than a full-inspection approach.

How It Works & What You Need to Qualify

Valuation Process

Instead of ordering a full, physical appraisal, lenders offering a “home equity no appraisal” product typically use one or more of the following methods:

-

AVM (Automated Valuation Model): A computerized algorithm uses public records, recent comparable sales, and property features to estimate value.

-

Desktop or Drive-By Review: Some lenders may still perform a minimal inspection (exterior only) or rely on photos and data rather than a full in-person inspection.

-

Appraisal Waiver: If you had a full appraisal recently (within a timeframe acceptable to the lender), they might accept it instead of ordering a new one.

Because these methods reduce time and cost, you often see faster approval and lower upfront expense. For example,e: some lenders tout funding in as little as 5 days for no-appraisal HELOCs.

Borrowing Limit & Equity Calculation

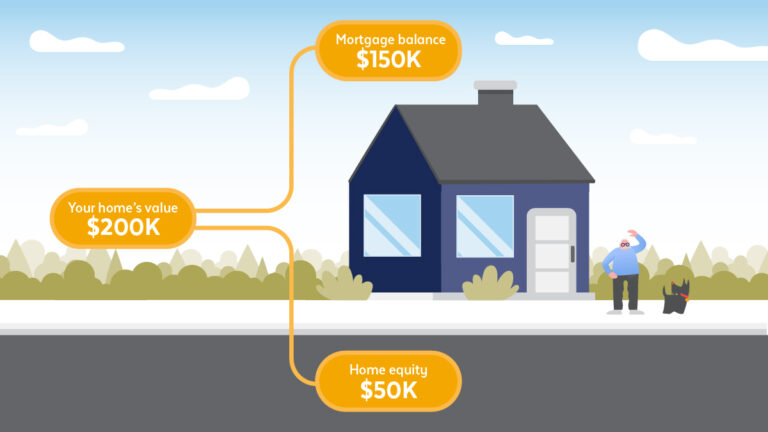

Once the valuation is estimated, the lender subtracts your existing mortgage (and any other liens) to determine your available equity. They then decide how much you can borrow (often expressed as a percentage of value, or LTV).

Because a no-appraisal valuation may be more conservative, the borrowing limit might be lower than a traditional appraisal case or the rate slightly higher to offset risk.

Qualification Requirements

Because skipping a full appraisal introduces more risk for the lender, you’ll often see stricter borrower standards for these products:

-

Strong credit score (often 680+ or higher)

-

Significant home equity already built up

-

Property in a stable market with reliable data

-

Lower debt-to-income ratio

-

Possibly borrowing below a certain loan amount threshold (e.g., under $100,000 or under a certain cap) for the no-appraisal advantage to apply.

In short: you’re opting for speed and convenience, but you need to present a strong profile.

Benefits of Choosing Home Equity No Appraisal

Faster Access to Funds

One of the biggest selling points is speed. With a full appraisal, scheduling inspections, waiting for reports, and underwriting can stretch the timeline. With a no-appraisal product, once the value is estimated via AVM or other methods, the approval and funding process can be significantly quicker. For homeowners who need funds for urgent repairs, debt consolidation,n or investment opportunities, this speed is valuable.

Lower Upfront Costs

Traditional appraisals typically cost several hundred dollars (sometimes more, depending on property size and location). When the appraisal requirement is waived or reduced, you save on that cost upfront. Some lenders advertise no appraisal fees or reduced fees for certain amounts.

Reduced Hassle and More Convenience

No need to schedule an appraiser, prepare your home for inspection, ensure someone is available, etc. Online lenders offering no-appraisal products often provide streamlined digital applications, making the process more convenient for borrowers. For example, lenders advertise full online applications, quick decisions, and fewer physical steps.

Flexibility of Use

Because you’re tapping into your home’s equity, you can direct funds to many purposes: home improvement, debt consolidation, education, or major purchase. The no-appraisal path simply makes the process quicker and less cumbersome.

Ideal for Certain Use Cases

If your credit is strong, your home value is stable, and you want speed over pushing for the largest possible loan amount, then a no-appraisal home equity product may be just right. It addresses the problem of waiting weeks for an appraisal when time is of the essence.

Real-World Lender Products That Offer Home Equity No Appraisal

Here are five real products or lenders that provide home equity solutions with minimal or no appraisal requirements. We’ll detail each with its features, benefits, and how you can access them.

Figure Home Equity Line (HELOC) – No In-Person Appraisal Under $400K

Features: The Figure advertises that loans under $400,000 do not require an in-person appraisal. The process is entirely online: apply, prequalify, and funds can be available in as few as 5 business days. You can borrow from $15,000 to up to $750,000 (depending on home value).

Use Case: Ideal if you already have substantial equity, want fast access, and prefer a digital experience.

Benefit: Speed, convenience, and fewer upfront costs since no in-person appraisal is required for eligible amounts.

How to Use: Click the link, complete the application, meet their criteria (credit, equity, property type), and once approved, draw funds as needed.

LoanDepot EquityFREEDOM Home Equity Loan – “No Appraisal Required”

Features: This product advertises “NO appraisal required” for their home equity loan option. It’s a fixed-rate loan (second mortgage) rather than a line of credit.

Use Case: If you prefer a lump-sum loan with fixed payments for a large project (e.g., major renovation, debt consolidation), and want to skip the appraisal step.

Benefit: Fixed repayment structure, no appraisal cost/time, clarity of payments.

How to Use: Visit the link, apply, get terms, confirm the no-appraisal claim for your scenario, and proceed if you meet the criteria.

Alliant Credit Union HELOC – Up to $250,000 With No Appraisal Fees

Features: For HELOCs up to $250,000, Alliant does not charge appraisal fees. While not exactly “no appraisal required,” the cost barrier is removed for many borrowers.

Use Case: Great if you need a moderate amount, want minimal upfront cost, and banking membership is accessible.

Benefit: Save on appraisal fees, get a line of credit up to 85% LT, V, and flexible draw and payback terms.

How to Use: Become a member (if needed), apply, ensure your amount qualifies for the no appraisal-fee threshold, and proceed.

Connexus Credit Union – Best Overall No-Appraisal Home Equity Lender According to Money.com

Features: Money.com lists Connexus as “Best Overall” for no-appraisal home equity loans, allowing both loans and lines up to high LTV (e.g., 90%) in some cases. Money

Use Case: If you are eligible for Connexus membership, want the highest borrowing limits and flexible options without a traditional appraisal.

Benefit: Strong terms, minimal appraisal process, high trust (credit union).

How to Use: Check membership eligibility, apply via their website, see if your scenario qualifies for the no-appraisal variant, and borrow accordingly.

Rate (formerly Guaranteed Rate) No-Appraisal HELOC Option

Features: Rate is listed among lenders offering HELOC or home equity lines with no appraisal required up to certain amounts (e.g., under $400,000) and competitive rates starting at ~6.25%.

Use Case: If you want a lower rate and meet the high borrower standards (credit, equity), this could be an appealing path.

Benefit: Competitive interest, no appraisal step for eligible loan size, quicker funding timeline.

How to Use: Visit their site, verify qualification for the o-appraisal path, apply, and proceed if eligible.

Why People Use These Home Equity No AppraisaProductst:s Use Cases

Home Renovation or Major Repairs

Many homeowners tap home equity to fund significant repairs: e.g., roof replacement, plumbing/heating overhaul, or major remodel. When the need is urgent, waiting weeks for a traditional appraisal delays progress and may increase cost. A no-appraisal home-equity product allows faster access to funds so you can fix the issues before they escalate.

Debt Consolidation

If you carry high-interest credit card debt or personal loans, converting that debt into a secured home equity loan or HELOC can reduce interest rates and simplify repayment. Using a no-appraisal product reduces upfront cost and speeds up access, helping you stabilize your finances earlier.

Investment Opportunity or Business Need

Whether you want to buy a rental property, invest in your real business, or seize a timely opportunity, capital speed can matter. By bypassing the appraisal, you reduce delay and can move quickly, assuming you meet the lender’s criteria and don’t need the absolute maximum loan size.

Lower Upfront Costs & Convenience

If you dislike appraiser visits, inspection appointments, prepping your home, and waiting days to weeks for a report, the no-appraisal option offers a streamlined path. Fewer hoops to jump through means less hassle and potentially lower closing costs.

When Property Condition Is Solid & Market Clear

If your property is in a region with good data, recent sales, and your home is in strong condition, the risk to the ender is lower, so they’re more likely to offer no-appraisal products. If you meet borrower standards (credit, equity), this scenario fits nicely.

How to Apply & Where to Buy

Step-by-Step Application

-

Estimate Your Home Equity: Use online tools, review your mortgage balance, and subtract it from the estimated value.

-

Check Your Credit & Financial Profile. Ensure your credit score, debt-to-income, and payment history are strong.

-

Research Lenders Offering “No Appraisal” Home Equity Product. Use the examples above and compare terms, rates, fees, and geographic eligibility.

-

Choose a Lender & Apply Only. For many no-appraisal options, you’ll apply digitally, upload docs, and receive faster decisions.

-

Review Terms & C.lose Ensure you understand the draw period (for HELOCs), repayment terms, interest rate (fixed or variable), and any fees.

-

Use Funds Responsibly. Whether for remodel, debt, investment, or other purpurposeseep track of how you use the funds and maintain your payment discipline.

Where to Apply (Buttons for Easy Access)

→Apply for a Figure Home Equity Line

→ Apply at LoanDepot EquityFREEDOM

→ Apply at Alliant Credit Union HELOC

→ Explore Connexus Credit Union No-Appraisal Home Equity

→ Explore Rate Home Equity No-Appraisal Option

Tips for Choosing the Right Product

-

Compare not just the interest rate but the total cost (fees + rate + repayment flexibility).

-

Confirm the no-appraisal variant applies to your scenario (loan size, property type, location).

-

Ensure the property type and location are eligible some lenders exclude unique or hard-to-value homes.

-

Ask about whether there is still a “valuation” or “desk review”; “no appraisal” often means no full inspection, but something will still be used.

-

Have a clear plan for how you will use the funds and how you will repay. Remember, your home is collateral.

Risks & Things to Consider

-

Lower Borrowing Power or Higher Rates: Because valuation may be more conservative without a full appraisal, you may receive a lower loan amount or a higher interest rate.

-

Fewer Lender Options: Not all lenders offer truly no-appraisal home equity products; you might have fewer choices.

-

Property Value Uncertainty: Without a full appraisal, you may not know if your home has as much value as you think; the lender’s estimate may differ from what a full appraisal might show.

-

Collateral Risk: Since the loan is secured by your home, failure to repay can lead to foreclosure. Using the funds responsibly is crucial.

-

Scope Limitations: Some “no appraisal” offers only apply under certain conditions: lower loan amounts, primary residences, homes in defined markets, and certain LTV thresholds.

-

Appraisal Variance: Valuation methods like AVMs may not always capture unique home features or market nuances; you may miss out on borrowing based on full potential value.

Final Thoughts

If you meet strong credit criteria, have substantial equity, and need access to your home’s value quickly and with less hassle, a home equity no appraisal product can be a smart choice. It offers speed, convenience, and reduced upfront cost. However, it’s not the right choice for everyone: you may get less borrowing power, face slightly higher rates, or have fewer product options. Compare offers carefully, read the fine print, and ensure your home, credit profile, and goals align with the lender’s criteria. With the right approach, it’s a tool you can use to unlock value and meet your financial goals.

Frequently Asked Questions

Q1: Can I really get a home equity loan or HELOC without any appraisal at all?

Yes — in certain cases. Some lenders offer home equity or HELOC products where a full in-person appraisal is waived and an AVM or desk review is used instead.

However, you still need to meet lender criteriaa and there may still be a “valuation” step of some kind.

Q2: Are the interest rates or loan limits worse if I skip the appraisal?

Potentially, yes. Because the lender is taking on additional risk by not requiring a full appraisal, you may see slightly higher interest rates, stricter qualification rrequirementsts or lower maximum loan amounts.

Q3: When is it a good idea to use a “no appraisal” home equity option versus a full appraisal option?

It’s a good ideawhen: you need access quickly, your property is in a stable market, you have strong credit and equity, and you don’t need the absolute maximum loan amount oor the rowest possible rate. If you have an unusual property, in a weak market, or you need a very large loan, a full appraisal may be more beneficial.