Home Equity Appraisal Requirements – Everything Homeowners Must Know

When you’re looking to tap into your home’s value through a home equity loan or line of credit, one of the key steps is satisfying the home equity appraisal requirements set by lenders. These requirements determine how much equity you truly have, how much you might borrow, and whether you qualify. In this article, we’ll cover what appraisal requirements are for home-equity products, how they work, what you’ll need to qualify, the benefits, real-world service providers you can engage, how to buy the service, use cases, and FAQ. Let’s jump in and get you fully informed.

Why Appraisal Requirements Exist and What They Cover

Lenders require appraisals for home equity products because your home is the collateral. They need a reliable estimate of its current value so they can judge risk, set loan-to-value (LTV) limits, and determine how much you can borrow. According to Chase, “Most lenders require a home appraisal early in an application for a HELOC or home equity loan. The appraisal helps determine the current equity.”

An appraisal covers multiple aspects: the home’s condition, features, comparable recent sales in your neighborhood, value of improvements or deficiencies, and how all these influence the fair market value. For example, CBS News explains that the appraisal evaluates “…the features of the home: Do you have a home security system? Outdoor amenities like a kitchen, pool, or hot tub? Any features that can raise your home’s value…”

Because home equity borrowing is a serious financial move, appraisal requirements protect both you and the lender from over-borrowing or undervaluing the property. They ensure the value is real, the equity margin exists, and the risk is controlled.

What Specific Appraisal Requirements You’ll Face

Minimum Equity, Credit, and LTV Standards

Before even getting into the appraisal itself, lenders typically require you to meet eligibility criteria. For instance, Bankrate notes that that current HELOC and home equity loan requirements include having at least 20% equity, a credit score in the mid-600s, and debt-to-income (DTI) ratios under approximately 43%. Bankrate.. These preconditions ensure minimal risk.

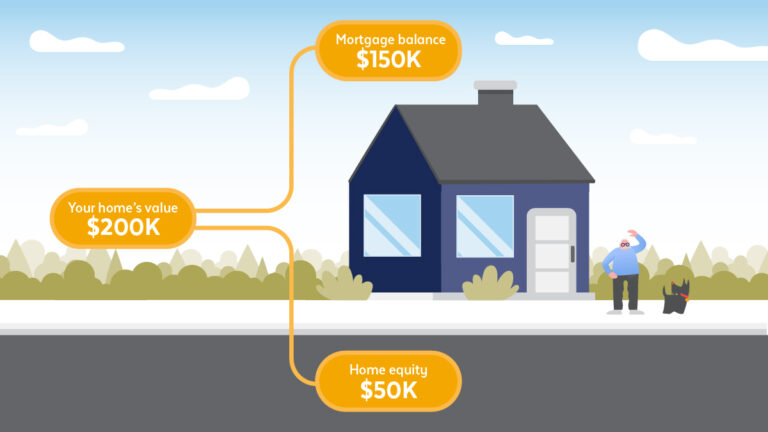

When the appraised value comes in, lenders will subtract your existing mortgage balance to determine available equity and apply a maximum LTV for the product. If the appraised value is low, you may not qualify for the amount you hoped. For That’s why proper appraisal requirements are so important.

Types of Appraisals and Their Depth

Not all appraisals are created equal; the requirements differ based on loan type, loan size, property type, and risk. According to Aloft Appraisal, there are different appraisal types: full appraisal (interior + exterior inspection), drive-by/exterior-only, and desktop appraisal (no visit, just data).

Lenders determine which type they require based on how much risk they assume. Some larger home equity loans require a full appraisal to meet regulatory standards; some smaller ones may allow a lighter valuation. For example, the National Credit Union Administration (NCUA) regulation says that if the loan amount is $100,000 or less, a credit union may rely on a written estimate rather than a full appraisal, provided risk is low.

What Appraisers Examine

When the appraiser arrives (or uses remote methods), they’ll inspect: the exterior and interior condition, upgrades done, the market of similar homes, recent sales in the area, neighborhood characteristics, zoning or restriction issues. As described by the Federal Deposit Insurance Corporation (FDIC), the appraisal helps determine the home’s value and the relationship between the loan amount and the ome value.

They will review the home’s physical condition (structural issues, wear and tear), features (pool, deck, remodeled kitchen), and how comparable homes sold recently in similar condition. All this is part of the appraisal requirements.

Benefits of Meeting Strong Appraisal Requirements

Access to Greater Borrowing Power

If your appraisal comes in strong, meeting those appraisal requirements means you may qualify for more borrowing. Since the lender uses that valuation to set your loan amount, a favorable appraisal gives you a stronger starting point. Conversely, if your appraisal is weak, borrowing power shrinks.

Better Loan Terms and Lower Risk

By satisfying appraisal requirements fully, you reduce lender risk, which can help you secure better terms: lower interest rates, higher LTV allowances, or fewer restrictions. Essentially, meeting requirements means you look like a more reliable borrower.

Faster Approval and Smooth Process

When you know the appraisal requirements and prepare accordingly, you can avoid delays. Making sure your home is in good condition, comparable sales data is available, and your documentation is ready helps the process flow. This saves time and can reduce costs. For example, knowing ahead the type of appraisal required (full vs desktop) helps you set expectations.

Better Financial Planning

Strong appraisal outcomes and clear appraisal requirements mean you are better informed about how much you can borrow, what interest you’ll pay, and how it impacts your home’s collateral. That helps you plan your renovation, refinance, or debt consolidation more confidently.

Top Appraisal Service Providers You Can Engage

Here are five real-world appraisal service providers (think of as “products” you can purchase) you can engage to help meet appraisal requirements for home equity transactions. I’ll include details, benefits, and how to engage.

Aloft Appraisal

Details: Aloft Appraisal’s blog explains different appraisal types and what home equity loan appraisal requirements might entail, noting that the type of appraisal required depends on the lender, loan amount, and property.

Benefits: They provide clarity on appraisal types, educate clients on what to expect, and help homeowners prepare for appraisal requirements.

Use Case: If you’re planning a home equity loan and want to understand the appraisal requirements, engage Aloft to get a preliminary walk-through.

How to Buy: Visit their website, schedule a consultation, and request an estimate for an appraisal service.

Why People Use It: Provides transparency and preparation assistance: you’ll know what your home must look like to satisfy appraisal requirements.

Point (Home Equity & Appraisal Blog/Platform)

Details: Point’s blog explains appraisal requirements for home equity loans and notes the majority of lenders require appraisals, but some exceptions exist.

Benefits: Educational resource helping homeowners understand what appraisal requirements lenders set, and how you might meet them or find alternatives.

Use Case: If you’re early in the process and want to compare appraisal requirements, types, costs, and how they affect your borrowing.

How to Buy/Use: Use the site for research; there may be links to their home equity products or referral to appraisal services.

Why People Use It: To gain insight into appraisal requirements, what lenders expect, and how to prepare.

Rocket Mortgage (Equity Loan Appraisal Process)

Details: Rocket explains that “your home equity loan will typically require an appraisal to protect your mortgage lender” and details qualification tiers (credit score, LTV) and appraisal requirement specifics.

Benefits: Clear breakdown of how appraisal requirements intersect with credit, equity, and LTV for home equity loans.

Use Case: If you’re looking to apply through Rocket Mortgage or r similar lender, and want to ensure you meet their specific appraisal requirements.

How to Buy/Use: Visit the link, review their requirements, use their application process, which includes an appraisal service as part of the an.

Why People Use It: Direct insight into the appraisal requirements your lender will impose.

Discover (Home Equity Loan Appraisal Process)

Details: Discover’s article outlines what to know about the appraisal before you apply for a home equity loan: what’s evaluated, how the appraisal helps determine equity, etc.

Benefits: Helps homeowners understand appraisal requirements ahead of time: what factors matter, what inspections to expect.

Use Case: If you want to proactively meet appraisal requirements and have your home ready.

How to Buy/Use: Review the article, then choose their loan product, which will include appraisal service as part of the package.

Why People Use It: To reduce surprises at the appraisal stage and satisfy lender appraisal requirements.

Experian (Information on HELOC Appraisals)

Details: Experian explains that when you apply for a HELOC, lenders typically require an appraisal so they can work with an accurate property value and equity amount.

Benefits: Good for understanding how appraisal requirements apply specifically to HELOCs (lines of credit) rather than just home equity loans.

Use Case: If your goal is a HELOC, and you want to know what appraisal requirements will be set.

How to Buy/Use: Review the link for prep, then apply via a lender that references these requirements.

Why People Use It: Gain clarity on appraisal requirements for HELOCs and how to meet them.

How to Meet Appraisal Requirements & Prepare Your Home

Clean, Repair, and Upgrade Where Possible

One of the key ways to meet appraisal requirements is to ensure your home’s condition is strong. The appraiser will assess condition, amenities, and any defects. As noted by the blog on preparing for appraisal by Point, “Make sure it’s clean… increase curb appeal… note your upgrades.”

Before the appraisal inspection or review, fix minor defects, clear clutter, and pad curb appeal (trim landscaping, paint exterior if needed). This will help the appraiser see a well-maintained home and reflect a better value.

Provide Documentation for Upgrades & Comparable Sales

If you’ve done meaningful upgrades (kitchen remodel, new HVAC, exterior improvements), let the appraiser know or provide documentation. The appraiser must evaluate features and improvements as per appraisal requirements. As explained by CBS News, features and coconditionsan impact the appraisal. No comparable sales in your area. This helps support value. The more solid data you provide, the better the appraiser can meet the requirement of accurate valuation.

Understand and Meet Lender’s Criteria

Review the lender’s appraisal requirements: Does a full appraisal (interior + exterior) apply, or will a desktop or exterior-only appraisal suffice? For example, Aloft Appraisal explains different types and mentions tthat the ender,l oan type,and location dedeterminerequirementst.

AlAlsoensure your equity, credit, and DTI meet minimums before applying. Bankrate notes typical criteria.

Be Ready for Appraisal Cost & Turnaround

Appraisal costs vary by property size, location, and type. According to Money, appraisal cost can range from $200 to $700 or more, depending on location.

Turnaround time is also important. If your home value is volatile or the market is moving fast, a delayed appraisal could affect your eligibility. Make sure you schedule promptly after the condition is ready.

Use Cases: Why These Appraisal Requirements Matter

Funding Major Home Renovations

Imagine you want to borrow $100,000 from your home equity to renovate the kitchen and add an extension. To do that, the lender will impose appraisal requirements (condition, comparable sales, value) so they know your home’s value supports the borrowing. If you meet them, you can access funds with confidence.

Debt Consolidation Through Home Equity

A homeowner with high-interest credit card debt decides to use a home equity loan to consolidate. The lender will apply appraisal requirements to determine how much borrowing is safe. If you prepare your home and meet appraisal requirements, you’ll likely access a better amount and cost.

Responding to Unexpected Expenses

Say your home’s HVAC system fails and you need emergency repair plus remodel. You apply for a home equity line of credit. The lender’s appraisal requirements still apply; your home must meet condition standards and value standards. Being ready for these helps you get funds faster.

Planning for Investment or Cash Flow

Maybe you want to borrow against your home to start a small business or invest in property. Appraisal requirements govern how much you can borrow safely. By meeting them (condition, equity, Documentation), you reduce risk and unlock opportunity.

Final Thoughts

Understanding home equity appraisal requirements is vital if you intend to borrow against your home’s equity. These requirements determine eligibility, borrowing amount, cost, and speed. By knowing what lenders expect (condition, comparable sales, credit, equity), preparing your home and documentation, and engaging the right appraisal service providers, you put yourself in the driver’s seat. Appraisal requirements aren’t just a hurdle; they’re a tool to secure a solid loan, get value for your home, and borrow responsibly. If you’re planning to tap your equity, start preparing early and meet the requirements confidently.

Frequently Asked Questions

Q1: Do I always need a full in-person appraisal to apply for a home equity loan or HELOC?

Most of the time, yes. Many lenders require full appraisals, including interior and exterior inspections, to determine the value and satisfy appraisal requirements. However, some lenders accept alternatives (desktop, drive-by, AVM) under specific conditions, so it depends on the lender, amountnt and property.

Q2: Why do appraisal requirements affect how much I can borrow?

Because lenders use the appraised value to determine your available equity and apply loan-to-value limits. If your home is appraised lower or fails condition checks, your borrowing amount shrinks. Conver,se strong appraisal satisfying requirements gives you more access.

Q3: How can I improve my chances of meeting appraisal requirements for home equity borrowing?

Start by ensuring your home is in good condition: fix obvious defects, cland ean, and improve curb appeal. Document any upgrades you’ve done. Research recent sales nearby. Check that you already have sufficient equity, a good credit score, and low debt-to-income. Choose a lender upfront whose appraisal requirements you understand and prepare accordingly. p