HELOC Without Appraisal – Fast Access to Home Equity Made Simple

When you’re a homeowner looking to tap into your home’s equity but dread the old appraisal process, a HELOC without an appraisal might sound like the dream. You skip the lengthy in-person inspection of your property, avoid additional fees, and could potentially access funds faster. In this article, we’ll walk through what such a product is, how it works, who it’s for, real-world lender examples, its benefits and risks, how to apply, and FAQs to wrap it up.

What Is a HELOC Without Appraisal

A HELOC (Home Equity Line of Credit) without appraisal refers to a home-equity line of credit product in which the lender does not require a full traditional in-person property appraisal to determine the value of your home. Instead, the lender may rely on alternative valuation methods such as an Automated Valuation Model (AVM), a desktop appraisal, a drive-by inspection, or use a recent appraisal you already have.

In a traditional HELOC scenario, the lender orders an appraisal to accurately figure out your home’s current market value, so they know how much equity is available and determine the risk. With a no-appraisal variant, that step is either skipped or replaced by a simpler method, meaning potentially faster approval and lower upfront cost.

Because of this, the product is transactional in nature: you’re using your home equity as collateral, and the key differentiator is the “without appraisal” feature, so that’s our top keyword.

How It Works & What You Need

When you apply for a HELOC without appraisal, the workflow differs slightly from a traditional HELOC:

Valuation Process

Instead of an appraiser visiting your property and inspecting the interior/exterior, taking measurements, assessing the condition, and comparing similar homes (which could take days or weeks), the lender uses one of these methods:

-

Automated Valuation Model (AVM): algorithmic estimation of your home’s value using public records, recent comparable sales, etc.

-

Desktop or drive-by inspection: minimal or no in-person contact; uses exterior inspection or public records.

-

Use of a recent prior appraisal: if you had an appraisal within a certain timeframe (e.g., 60–180 days), some lenders will accept it and bypass a new one.

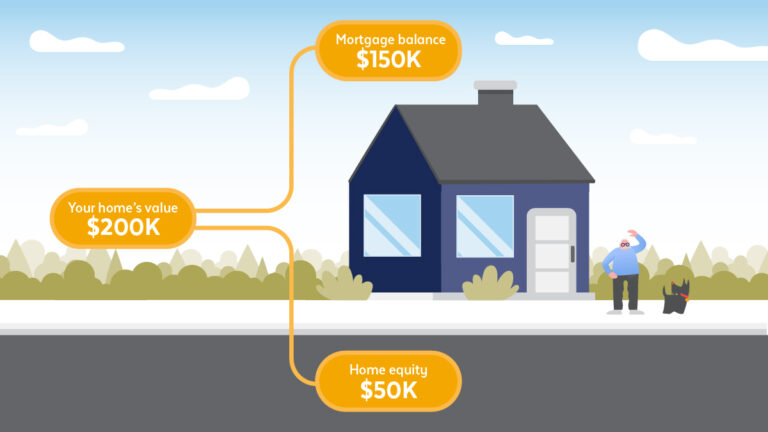

Borrowing Limit & Equity

Once the value is estimated, the lender subtracts your existing mortgage balance (and any other liens) to determine your available equity. They then decide how much you’re eligible to borrow, often expressed as a percentage of the value (loan-to-value ratio). With “no-appraisal” products, because valuations may be more conservative, borrowing limits might be tighter.

Requirements & Qualifying

Because skipping a full appraisal raises the lender’s risk, you’ll often need to meet stricter criteria:

-

Strong credit score (often high 600s or 700+).

-

Significant home equity (so that even a conservative valuation still leaves enough collateral).

-

Low debt-to-income ratio and stable income.

-

Property in a stable market or region where AVMs can reliably estimate value.

Speed & Cost Advantage

By avoiding in-person appraisal costs (which can run from $350-$800 or more) and long wait times, these HELOCs can close faster and with less upfront cost.

Benefits of a HELOC Without Appraisal

Because the product is structured to bypass some traditional steps, it offers several appealing benefits:

Faster Access to Funds

Without waiting for the appraiser to schedule, visit, inspect, report, and the lender to review, you can often finalize and fund the HELOC much quicker. Some reports say closing in as little as 7-10 days is possible when skipping g full appraisal.

If you have urgent financial needs, major home repair, medical expense, or immediate refinancing, this speed can be a game-changer.

Lower Upfront Costs

Since you avoid or reduce the cost of a full appraisal, you save money upfront (appraisal fees, perhaps fewer inspection costs). That means more of your funds go toward actual use rather than fees.

Convenient & Digital Friendly

Many lenders offering appraisal-waiver HELOCs have streamlined online processes: apply online, submit documents digitally,, and have less home-visit hassle. For example, Figure advertises “no in-person appraisal needed for loans under $400K” and funding in as few as 5 days.

Flexible Use of Funds

As with standard HELOCs, you generally have a line of credit you draw from as needed, pay interest only on what you borrow, and can reuse during the draw period. This flexibility remains even with the no-appraisal variant.

Ideal for Certain Goals

If your goal is quick access to home equity for renovation, debt consolidation, or an investment opportunity, and you meet the criteria, the no-appraisal route makes sense.

Real-World Lender/Provider Examples

Let’s dive into real examples of lenders offering HELOCs without full appraisal or with appraisal waivers. Each has its own features, pros, and cons.

1. Figure – No In-Person Appraisal HELOC

Details: Figure offers a home equity line up to $750,000 and states explicitly “No in-person appraisal needed for loans under $400K.” They use AVMs and automated systems to value the home.

Use Case: If you have strong credit and want access fast, this product is designed for speed and digital convenience.

Pros: Fast, online, no traditional appraisal for smaller amounts, large max line.

Cons: The “no appraisal” benefit may only apply up to certain limits (<$400K), and you still must meet strict credit/equity criteria.

2. Better.com – Appraisal-Waiver HELOC Option

Details: Better.com outlines how you may get a HELOC “without appraisal” if you meet requirements: sufficient equity, strong credit, and property in a stable market.

Use Case: For borrowers who want the convenience of skipping the in-person appraisal and already satisfy strong financial metrics.

Pros: Streamlined application, decent brand reputation.

Cons: Not guaranteed waiver depends on property type, location, and your profile; may still have higher rates or more limited terms.

3. Griffin Funding – Digital HELOC with AVM + PCR

Details: Griffin Funding mentions that “in some cases lenders will allow no-appraisal HELOCs” and that they use AVMs plus a Property Condition Report (PCR) rather than full appraisals.

Use Case: Homeowners who need up to a moderate amount fast and are comfortable with digital underwriting.

Pros: Modern underwriting, fast timelines.

Cons: AVM valuations may limit borrowing power; still need strong credit and equity.

4. Connexus Credit Union – No-Appraisal Home Equity Loan & HELOC

Details: According to a Money.com review, Connexus was ranked among the best no-appraisal home equity lenders for October 2025. Money

Use Case: Borrowers who are members of the credit union and qualify under their terms.

Pros: Lower interest rates, high maximum LTV, faster funding in some cases.

Cons: Membership requirement; located in certain regions; terms may vary.

5. BECU – HELOC with “No Appraisal Costs”

Details: While not always completely “no appraisal,” BECU lists HELOC features including “No appraisal costs, title insurance fees, document mailing fees…” suggesting they streamline or cover appraisal‐related costs.

Use Case: If you are eligible for membership and want minimal upfront costs.

Pros: Reduced fees, flexible terms.

Cons: May still require valuation; coverage may depend on member status and property.

Why You Might Need a HELOC Without Appraisal – Use Cases

Here are some real-life scenarios where this product fits well:

Home Renovation or Major Repair

Say your home suffered damage (roof leak, flood, bad plumbing) and you need $50,000 quickly to fix it before the damage worsens. A HELOC without appraisal gets you funds faster than the long appraisal process, allowing timely repair, reducing risk of further damage, and preserving home value.

Debt Consolidation

You have high-interest credit cards or personal loans (20%+ APR) and plenty of home equity. A HELOC without appraisal allows you to consolidate those debts into a lower-interest secured line of credit, with less upfront hassle, letting you save on interest and simplify payments.

Business or Investment Opportunity

You spot a time-sensitive investment or business opportunity and don’t want to wait weeks for a full appraisal to assess equity. With a lender that offers no-appraisal HELOC, you can draw funds quickly, seize the opportunity, and either repay early or convert later.

Tax Deductibility & Smart Use

Home equity line interest may be tax-deductible when used for home improvements (consult tax advisor). By using a quick access HELOC without appraisal, you combine speed + potential tax benefit. While skipping appraisal doesn’t affect deductibility, the quicker access gives you flexible timing.

When Traditional Appraisal Is Unappealing

Maybe your home has unusual features, or the local appraisal market is slow/costly. If paying $400+ for an appraisal and waiting 2-3 weeks is a pain, then finding a lender willing to rely on AVM simplifies things, reduces cost, and stress.

Step-by-Step Application

-

Estimate your home’s value and existing mortgage or lien balances to calculate your available equity.

-

Check your credit score, debt-to-income ratio, and ensure your income and payment history are strong.

-

Research lenders offering “HELOC without appraisal” or “appraisal waiver” programs, review their terms, rates, fees, and maximum amounts.

-

Apply online (many digital lenders allow a full online process), provide documents: ID, proof of income, mortgage statements, property info.

-

Upon approval, review the draw period, repayment terms, interest rate (fixed or variable), and costs/fees. Then close and draw funds.

Where to Apply (Affiliate-style Buttons)

→ Apply for Figure HELOC

→ Apply at Better.com HELOC

→ Apply at Griffin Funding HELOC

Note: Always check lender’s current availability, state restrictions, and product variant some “no appraisal” benefits may apply only under certain caps or specific conditions.

Tips for Choosing the Right Lender

-

Compare interest rates: skipping appraisal might come with a slightly higher rate, measuring to compare apples to apples.

-

Check maximum loan‐to‐value (LTV) allowed: some lenders may allow up to 80-90% LTV if value estimation is minimal.

-

Read small print: Some programs say “no in-person appraisal under $400K” or “if property meets certain AVM criteria.” For example, Figure’s “no in-person appraisal needed for loans under $400K.”

-

Understand fees: If the appraisal cost is waived, there may be origination, closing, draw period, and yearly fees.

-

Confirm property eligibility: Certain property types (investment homes, non‐standard construction) may not qualify for the no‐appraisal variant.

-

Repayment plan: While the draw period gives flexibility, after the draw period endss you must start paying principal + interest; make sure you’re ready for that.

Risks & Things to Be Aware Of

-

Without a full appraisal, home valuations may be conservative, meaning you might qualify for a smaller line than if you had a full appraisal.

-

Higher interest rates or more restrictive terms may apply because the lender assumes more risk.

-

Limited lender options: Not every bank offers true no‐appraisal HELOCs, so your choices may be fewer.

-

Property or market risk: If your area has volatile real estate or your home has unique features, an AVM may undervalue your home compared to a full appraisal; you could lose potential borrowing power.

-

Collateral risk: Because your home is collateral, failure to repay draws can lead to foreclosure. Using the credit line wisely is critical.

-

Draw period vs repayment period: After the draw period ends, you may face higher payment obligations; ensure you understand what you’ll pay.

Final Thoughts

A HELOC without appraisal is an attractive option if you meet the right criteria—strong credit, decent equity, stable income—and you need access to your home’s equity quickly and with less hassle. But it’s not perfect for everyone. Make sure you compare terms, understand any trade-offs, and use the funds for the right purpose. When used wisely, this product can be a smart financial tool.

Frequently Asked Questions

Q1: Can I really get a HELOC without any appraisal?

Yes, for some lenders, and under certain conditions, you can bypass a full in-person appraisal. They’ll use an AVM, recent appraisal, or desktop/drive-by method instead.

However, you’ll still need to meet stricter eligibility criteria (credit, equity, property type).

Q2: Does skipping the appraisal mean higher cost or worse terms?

Potentially yes. Because the lender is taking more risk by skipping the full appraisal, they may offset that via slightly higher interest rates, stricter borrowing limits, or more conservative valuations.

That’s why it’s important to compare offers and read the fine print.

Q3: Is the interest on a HELOC without appraisal tax-deductible?

If the HELOC is used for qualified home improvements and meets IRS rules, interest may be tax-deductible as standard HELOCs. The “without appraisal” feature does not in itself affect deductibility. However,, tax laws va,ry and youshouldd consult your tax professional.