Do HELOCs Require an Appraisal? What Homeowners Must Know

A Home Equity Line of Credit (HELOC) is one of the most flexible ways to access the equity in your home. Whether for renovations, debt consolidation, or emergency funds, many homeowners consider it a go-to option. But one common question is: Does a HELOC require an appraisal?

This article breaks down everything you need to know about HELOC appraisal requirements when they’re needed, how it works, what lenders expect, and real-world examples of how top lenders handle it.

Why Appraisals Are Usually Required for HELOCs

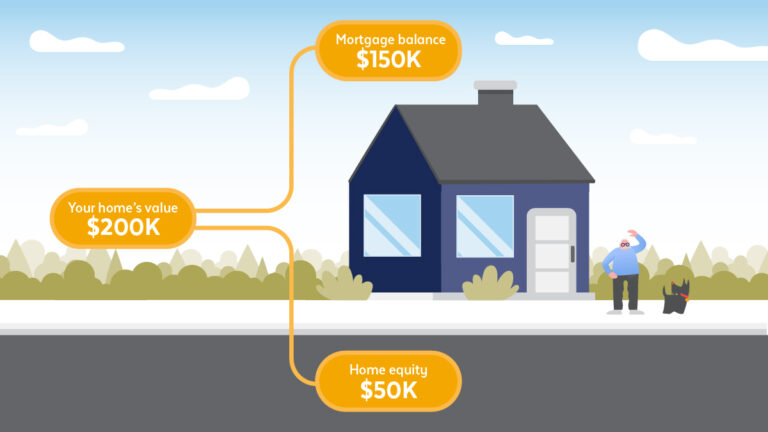

When applying for a HELOC, the lender uses your home as collateral. To protect both parties, they need to confirm the home’s current market value. That’s what an appraisal does: it establishes the fair value of your property in today’s market.

Most lenders require an appraisal at the beginning of a HELOC application to ensure the loan amount doesn’t exceed the home’s equity. It verifies the home’s condition, location, upgrades, and recent comparable sales. Without this, the lender can’t confidently set the borrowing limit or interest rate.

Appraisals also help you. They prevent you from over-leveraging your home and give peace of mind that your loan amount aligns with your real property value.

How the HELOC Appraisal Process Works

Step-by-Step Overview

-

Application – You apply for a HELOC and provide details about your home.

-

Appraisal Order – The lender hires a licensed appraiser to assess property value.

-

Property Review – The appraiser inspects condition, size, improvements, and neighborhood.

-

Market Analysis – They compare your home with similar properties sold recently.

-

Final Report – The report goes to the lender, showing the estimated market value.

-

Loan Decision – Based on that value, the lender decides your credit limit and approval.

Types of Appraisals Used

-

Full Appraisal: A complete inspection (interior and exterior) for the most accurate valuation.

-

Drive-By Appraisal: The appraiser checks the exterior only, often used for smaller HELOCs.

-

Desktop Appraisal: A digital estimate using market data and automated valuation tools.

The type used depends on your credit, equity, and the lender’s internal policy.

When HELOCs May Not Require a Full Appraisal

Some lenders now use automated valuation models (AVMs) instead of traditional in-person appraisals. This technology reviews public records, property databases, and recent market trends to estimate home value instantly.

A HELOC might skip a full appraisal if:

-

Your requested loan amount is relatively small.

-

You have excellent credit and high equity.

-

You’ve had a recent appraisal within the past year.

-

Your property is in a stable, data-rich market.

This approach reduces time and cost, allowing faster approvals, sometimes within a few days. However, you might qualify for a slightly smaller credit limit compared to a full appraisal.

Benefits of Understanding Appraisal Requirements

Better Preparation and Approval Rates

Knowing appraisal requirements in advance helps you prepare your home and documents properly. A well-maintained property, organized financial records, and awareness of comparable sales can lead to a higher valuation and faster approval.

Cost and Time Efficiency

Traditional appraisals can cost several hundred dollars and take over a week. Understanding when an automated valuation is possible helps you choose a lender that saves both time and money.

Stronger Borrowing Power

A positive appraisal can increase your home’s equity value, leading to a higher HELOC limit and better interest terms.

Top HELOC Products and How They Handle Appraisals

Here are real-world examples of how major lenders structure their HELOC appraisal requirements and benefits.

Figure Home Equity Line

Details:

Figure offers a fully digital HELOC with quick approvals. Instead of traditional appraisals, it often uses advanced valuation models to estimate home value.

Benefits:

-

Fast approval in days instead of weeks.

-

Lower fees due to no in-person appraisal.

-

Paperless process for convenience.

Use Case:

Ideal for homeowners who already have strong equity and want fast cash without waiting for an on-site inspection.

Rocket Mortgage Home Equity

Details:

Rocket Mortgage typically requires a full appraisal for its home equity loans and HELOCs. This ensures a precise valuation for borrowers needing large credit lines.

Benefits:

-

Higher accuracy and borrowing power.

-

Trusted by major lenders for underwriting.

-

Suitable for high-value properties.

Use Case:

Best for homeowners who want maximum loan amounts and don’t mind the traditional appraisal process.

Discover Home Equity Line

Details:

Discover uses standard appraisal procedures for home equity products, focusing on verified property valuations before loan approval.

Benefits:

-

Predictable process and reliable results.

-

Trusted national brand.

-

Competitive fixed and variable rate options.

Use Case:

Perfect for borrowers who value thoroughness and n established lender reputation.

Chase HELOC

Details:

Chase generally requires a home appraisal for both HELOCs and home equity loans. The valuation ensures responsible lending and accurate equity calculations.

Benefits:

-

Suitable for large or multi-property borrowers.

-

Backed by a major financial institution.

-

Transparent appraisal and lending criteria.

Use Case:

Ideal for homeowners looking for a traditional, in-person appraisal experience with high trust and reliability.

Point Home Equity

Details:

Point uses flexible appraisal methods, including automated or hybrid approaches. Depending on property data, borrowers may not need a full appraisal.

Benefits:

-

Quicker approval.

-

Modern digital process.

-

Lower upfront cost.

Use Case:

Good fit for homeowners in data-rich urban markets or those seeking rapid funding.

How to Prepare for a HELOC Appraisal

Step 1: Improve Home Condition

Small improvements painting, fixing broken fixtures, and updating lighting, can make a difference. The cleaner and more functional your home appears, the better the appraiser’s impression.

Step 2: Gather Documentation

Collect records of recent upgrades, renovation costs, or energy-efficient installations. These demonstrate added value that may increase your appraisal result.

Step 3: Know Your Neighborhood

Be aware of recent sales in your area. Appraisers often use nearby comparable properties as benchmarks, so having that data helps validate your home’s worth.

Step 4: Be Present During the Appraisal

If possible, attend the inspection to answer any questions and highlight upgrades the appraiser might overlook.

Step 5: Review the Report

Once done, request a copy. If you find inaccuracies, you can request reconsideration.

When a HELOC Appraisal Requirement Becomes a Problem and How to Solve It

Sometimes the appraisal value is lower than expected. Here’s what you can do:

-

Reassess Timing: Property values fluctuate; waiting a few months in a rising market can improve outcomes.

-

Provide Additional Data: If you’ve done upgrades not listed in public records, supply documentation.

-

Consider Another Lender: Some lenders rely on different appraisal models that may value your home differently.

A low appraisal isn’t the end; it just means re-strategizing to meet the lender’s criteria.

Why Understanding Appraisal Requirements Matters

Knowing exactly how appraisal requirements work gives you control over the borrowing process. You’ll:

-

Save time by applying to lenders whose methods match your needs.

-

Avoid surprise fees or delays.

-

Maximize borrowing potential through proper home preparation.

Understanding this requirement means you’re not just another applicant; you’re a prepared, informed borrower with leverage.

Frequently Asked Questions

Q1: Do all HELOCs require an appraisal?

Most do, but some lenders now offer appraisal-free HELOCs using automated valuation models. Whether one applies depends on your credit, equity, and property location.

Q2: How much does a HELOC appraisal cost?

It varies between $300 and $800, depending on property size, location, and whether a full or desktop appraisal is needed.

Q3: How can I increase my home’s appraised value?

Keep your home well-maintained, complete minor upgrades, clean before inspection, and document improvements such as energy efficiency upgrades or remodels.

Conclusion

A HELOC almost always requires some form of appraisal, whether traditional or digital. The process protects both you and the lender, ensuring the amount you borrow is safe and realistic. Understanding appraisal requirements helps you prepare effectively, save time, and maximize your home’s value.

If you’re ready to apply, start by choosing a lender whose appraisal process fits your goals, whether full inspection or fast digital verification, and prepare your home to make the best impression.