Fast HELOC No Appraisal – Unlock Your Home Equity in Days Without a Full Appraisal

When you’re a homeowner needing quick access to your home’s equity, a “fast HELOC no appraisal” might just be the game-changer. Instead of enduring weeks of waiting for a property appraiser, you access your line of credit faster and with fewer hurdles. In this article, we’ll break down what exactly the term means, how it works, the benefits and risks, real-life lender products offering it, how to buy/apply, use cases, and a handy FAQ. Let’s get into it.

What Does a Fast HELOC No Appraisal Mean

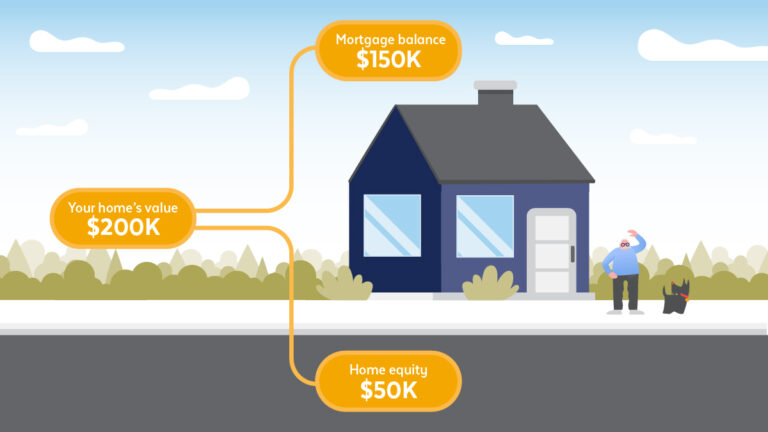

A HELOC (Home Equity Line of Credit) is a secured credit line that uses your home’s equity as collateral. A fast HELOC no appraisal refers to a HELOC product in which the lender does not require the traditional, in-person full property appraisal, or at least substantially reduces that step, and promises an accelerated timeline for funding application. Many lenders use automated valuation models (AVMs), desktop reviews, or recent appraisals to estimate home value.

By minimizing or eliminating the full appraisal requirement, the process becomes quicker, more streamlined, and less costly. According to one lender, “no in-person appraisal needed for loans under $400K … funding in as few as 5 days.” While the term implies speed and convenience, it’s important to note that not every borrower qualifies for the same terms; qualification criteria may be stricter.

How It Works & What You’ll Need

Valuation Process Without Appraisal

Instead of having an appraiser come in, measure your home, inspect interiors and exteriors, and compare multiple comps on site, the lender may rely on these methods:

-

AVM (Automated Valuation Model) using public records, recent comparable sales.

-

Desktop or drive-by inspection (minimal in-person contact).

-

The lender may waive the appraisal if you have had one recently and your property meets certain criteria.

This streamlined valuation saves time (often a week or more compared to a full appraisal) and upfront cost (appraisals may cost hundreds of dollars).

Eligibility & Qualification

Because the lender is taking on a bit more risk by skipping a full appraisal, they often impose stricter requirements:

-

Strong credit score (often 680+ or similar).

-

Substantial home equity has been built up (so risk is lower).

-

Property in a market with strong comparables (so AVM is reliable).

-

A borrowing amount that makes sense under the no-appraisal model (smaller loans may be more likely).

Borrowing Limit & Draw Terms

Once your home value is estimated, the lender subtracts any outstanding mortgage(s) and calculates how much you can borrow (expressed as a loan-to-value ratio). With no-appraisal products, the limit might be slightly lower or more conservative than full-appraisal offers.

Speed & Cost Advantages

Because the appraisal step is minimized or skipped, many lenders advertise funding in 5 to 10 days for eligible borrowers. Upfront costs can also be lower since you may not pay the full appraisal fee. Overall, for borrowers who qualify, this path offers a faster, smoother experience.

Benefits of Choosing a Fast HELOC No Appraisal

Rapid Access to Funds

One of the most compelling advantages is speed. Traditional HELOCs might require property inspection, scheduling, waiting for the report, and lender review, which can delay access by weeks. With the no-appraisal model, funding can occur in as little as 5 business days. For homeowners needing quick financial liquidity for home repairs, debt consolidation, or a time-sensitive investment, this is a major advantage.

Reduced Upfront Costs & Hassle

Appraisals typically cost hundreds of dollars and may increase closing costs. Skipping or reducing appraisal requirements can save you money. Additionally, less scheduling (no home visit required) means less disruption to your daily life. For those who value convenience and minimal paperwork, this path is attractive.

Convenience & Digital Experience

Many of the fast no-appraisal HELOCs are offered by digital lenders that let you apply online, upload minimal documents, and close electronically. For example, one lender states that their application is 100% online, and no in-person appraisal is needed for loans under a certain threshold. This convenience is especially useful in today’s digital environment.

Flexibility for Use

Because you’re borrowing against your home equity, you can direct funds to whatever you choose: major renovation, paying off high-interest debt, funding education, or investing. The fast, no-appraisal product adds the benefit of speed and less hassle.

Ideal for Certain Use Cases

If you already have strong equity, solid credit, and the property is in a well-established market, this no-appraisal product can fit well. It solves the problem of waiting for an appraisal when time is critical. For homeowners who don’t want to endure the appraisal process, this product offers a viable alternative.

Real-World Lender Products That Offer Fast HELOC No Appraisal

Here are five real-world products where lenders advertise fast HELOCs with little or no appraisal requirement. For each, I’ll cover features, benefits, use-case and how to access.

Figure Home Equity Line – No In-Person Appraisal Under $400K

Features: According to their site, “No in-person appraisal needed for loans under $400K.” They advertise a full online application, funding in as few as 5 days. Loan limits up to $750,000 (with property value and eligibility).

Use Case: Perfect for homeowners with strong credit, good equity, and needing access quickly.

Benefits: Speed (5-day funding), minimal appraisal requirement, digital process.

Why Choose It: If you need funds fast and meet their eligibility criteria (loan size, credit, equity).

How to Apply: Visit their website, apply online, view the rate, submit documents, get approval, and draw funds.

Griffin Funding Fixed-Rate Digital HELOC – No Appraisal Required

Features: Their “Fixed-Rate Digital HELOC” product states, “no appraisal required – get cash out quickly, within 5 business days.” Up to $400k loan amount, credit down to ~640 for primary residences.

Use Case: For borrowers wanting a fixed-rate HELOC, quick funding, and a digital experience.

Benefits: No appraisal fees, fast turnaround, less paperwork, and draw flexibility.

Why Choose It: You fit the eligibility and need speed, plus a fixed-rate option.

How to Apply: Apply via their site, get pre-approval in minutes, complete online docs, and get funds.

Upstart Mortgage HELOC – No Appraisal

Features: Their site says, “No appraisal needed … Apply and check your rate in minutes … Fast funding.” Upstart

Use Case: If you prefer a simplified application and have equity, and want fewer hurdles.

Benefits: Speed, convenience, minimal doc, potentially less cost.

Why Choose It: For a straightforward use case where time matters.

How to Apply: Visit the site, check the rate, complete the application, and if eligible, proceed to funding.

Citizens Bank FastLine® Digital HELOC – No Home Appraisal in Most Cases

Features: The page state, “No home appraisal in most cases. Apply … get your personalized offer in 2-3 minutes … close in as few as 7 days.”

Use Case: If you already bank with Citizens or prefer a branch presence plus digital convenience.

Benefits: Speed, convenience of hybrid digital/in-branch, and minimal appraisal process.

Why Choose It: Trusted institution, fast process, option for many borrowers.

How to Apply: Visit the product link, get a quote, review terms, and apply.

5. CCM Equity Express by CrossCountry Mortgage – Automated Valuation, Fast Funding

Features: The product uses automated valuation, states “close in a few minutes,” and “funds available in a few days.” They compare to typical HELOCs with appraisal and manual docs.

Use Case: If you want advanced automation and don’t mind a digital process.

Benefits: Fast timeline, fewer appraiser scheduling, competitive structure.

Why Choose It: If your priority is speed and minimal physical appraisal hassle.

How to Apply: Use their site, choose the fixed or variable option, and complete the digital application.

How to Buy & Where to Apply

Steps to Apply for a Fast No-Appraisal HELOC

-

Estimate your home’s current value and outstanding mortgage to determine equity.

-

Check your credit score, debt-to-income ratio, and ensure you meet lender eligibility.

-

Choose from lenders offering fast no-appraisal HELOCs (see list above) and compare terms (interest rate, draw period, fees, LTV).

-

Apply online: upload income proof, mortgage statements, property info, and complete the application.

-

Review the offer: ensure you understand the draw period, repayment, fees, and any conditions.

-

Close the loan: Many digital lenders allow electronic closing and wiring of funds.

-

Use the funds responsibly: remember the home is collateral, so use it with purpose.

Where to Apply (Affiliate-Style Buttons)

→ Apply for a Figure Home Equity Line

→ Apply at Griffin Funding Digital HELOC

→ Apply at Upstart Mortgage HELOC

→ Explore Citizens Bank FastLine HELOC

→ Explore CCM Equity Express (CrossCountry Mortgage)

Tips When Choosing

-

Confirm the “no appraisal” claim applies in your state, and for your size, often only up to a cap (e.g., under $400K) gets this benefit.

-

Compare interest rates and fees: skipping appraisal may save cost, but could come with a slightly higher rate or less favorable terms.

-

Ensure property type qualifies (some lenders exclude non-standard homes, investment properties).

-

Understand draw period vs repayment: HELOCs allow a draw period, then repayment; know your timeline.

-

Have a clear purpose for the funds and a repayment plan since your home is used as collateral; responsible use is key.

Use Cases – Why You Might Choose a Fast No-Appraisal HELOC

Emergency Home Repairs or Urgent Renovations

Imagine your home suffers a sudden major repair need roof leak, structural issue, or major systems failure. You need funds quickly and can’t wait for an appraiser to schedule.A fast no-appraisal HELOC lets you tap your equity swiftly, start repairs soon,e r and prevent further damage.

Debt Consolidation or High-Interest Debt Payment

If you have several high-interest credit cards or personal loans, moving them into a lower-rate HELOC can save money. The faster you get access, the sooner you can reduce interest costs. The convenience of Skippian NG appraisal helps you act quickly.

Investment Opportunity or Business Need

Perhaps an investment opportunity requires swift funding, maybe an opportunity to buy equipment, invest in property, or stabilize rental. A fast HELOC without a lengthy appraisal gives you that agility.

Lowering Upfront Cost & Reducing Hassle

If you dislike the process of coordinating an appraiser visit, prepping your property, or waiting weeks, this product suits your style. The simplified process means less disruption and fewer costs upfront.

When Home Equity and Market Conditions Are Strong

If you’ve paid down your mortgage significantly, home values are stable (or rising), and property is in a well-documented market, this fast, no-appraisal option becomes very viable. In effect, you’re leveraging your strong position for quicker access.

Risks & Things to Watch

-

Borrowing power may be lower: Because valuation is less extensive, lenders might apply conservative valuations, limiting how much you can borrow.

-

Possibly higher interest rate or stricter terms: Skipping appraisal increases lender risk, which may translate into stricter criteria or slightly higher rates.

-

Limited lender options: Not all lenders offer genuine no-appraisal fast HELOCs; you may have fewer options or special eligibility.

-

Collateral risk: Since your home secures the loan, failure to repay can result in foreclosure. Make sure you have a plan.

-

Property condition and market risk: If your home has unique features or is in a weak market, an AVM may undervalue it, and skipping an in-person appraisal might come back to bite.

-

Scope limitation: “No appraisal” often means “no full in-person appraisal,” not zero valuation. Some form of valuation or verification is still used.

Final Thoughts

A fast HELOC no appraisal can be an excellent solution if you meet the eligibility criteria: strong credit, substantial equity, property in a stable marmarketnd you need quick access to funds with less hassle. The key advantages are speed, lower upfront cost, and convenience. But it’s not a one-size-fits-all answer: you might get slightly less borrowing power, face stricter terms, and still need to understand your repayment plan since your home is on the line. Compare offers carefully, understand the trade-offs, and if used smartly, this product can unlock your home’s value efficiently.

Frequently Asked Questions

Q1: Can I really get a HELOC without a full appraisal and still access cash fast?,

Yes several lenders advertise HELOCs where no full in-person appraisal is required, and funding can happen in as few as 5-10 days.

However, you still need to meet lender eligibility (credit, equity, market conditions,etc.),s and there may be limits on loan size.

Q2: Are the terms worse if I choose a “no appraisal” HELOC?

Potentially yes. Because the lender assumes more risk by skipping some steps, you might see more conservative valuations, a lower maximum borrowing amount, or slightly higher interest rates.

That said, for many borrowers, the speed and convenience offset these trade-offs.

Q3: When should I avoid a fast no-appraisal HELOC and go for a traditional full-appraisal one?

You should lean toward a traditional full-appraisal HELOC if: you need a very large loan amount; your property is unique or in a market with weak comparable data; your credit or equity is marginal; or you want to maximize borrowing power rather than minimize time. In such a scenario, a full appraisal may benefit you more in the long run.