How to Secure Cheap Remortgage Conveyancing Services Without Compromising Quality

Remortgaging your home can already feel complex, so the legal fees around it often add to the stress. That’s why many homeowners are looking for cheap remortgage conveyancing services: legal help to switch lenders (or restructure your mortgage) at a lower cost. But “cheap” should not mean risky. You want value, legal expertise, transparency, speed, and still a good price.

This article walks you through what cheap remortgage conveyancing means, why it’s important, what influences costs, how to pick the right service, five real-world platforms/tools that support cost-effective conveyancing, and how to buy/choose. At the end, nd you’ll find FAQs.

What Is Cheap Remortgage Conveyancing?

Remortgage conveyancing refers to the legal process required when you switch your mortgage from one lender to another (or sometimes restructure) so that the new lender’s charge is properly registered and the old one extinguished.

Cheap remortgage conveyancing means you’re seeking that legal service at a competitive or lower-than-average cost while still obtaining the necessary legal work: verifying title, handling redemption of the existing mortgage, registering the new lender’s charge, and fulfilling lender requirements.

The key is that although the cost is low, the service still meets regulatory and lender requirements. If you choose a too cheap a provider without checking, you risk delays or even refusal by the lender.

Why Cheap Remortgage Conveyancing Matters

Cost Efficiency

Switching your mortgage can be driven by saving on interest rates or releasing equity. But legal fees add up. A cost-effective conveyancing service means you reduce one of the extra costs and make more of your remortgage savings.

Transparency & Risk Reduction

A lower cost doesn’t help if hidden fees pop up or the conveyancer misses lender requirements. Choosing cheap remortgage conveyancing means you look for clear fixed fees and full disclosure, giving you confidence and fewer surprises.

Speed & Efficiency

When you’re remortgaging, timing often matters (rate expiry, lender panel deadlines, etc). Many cost-efficient conveyancers use streamlined digital workflows to help things run faster, so you save time as well as money.

What Drives the Cost of Remortgage Conveyancing

Transaction Complexity

If you are simply switching lenders on the same property with no other changes, the work is straightforward and cheaper. If there are extra issues (buy-to-let, multiple charges, leasehold block over 11 m, overseas ownership), the cost rises.

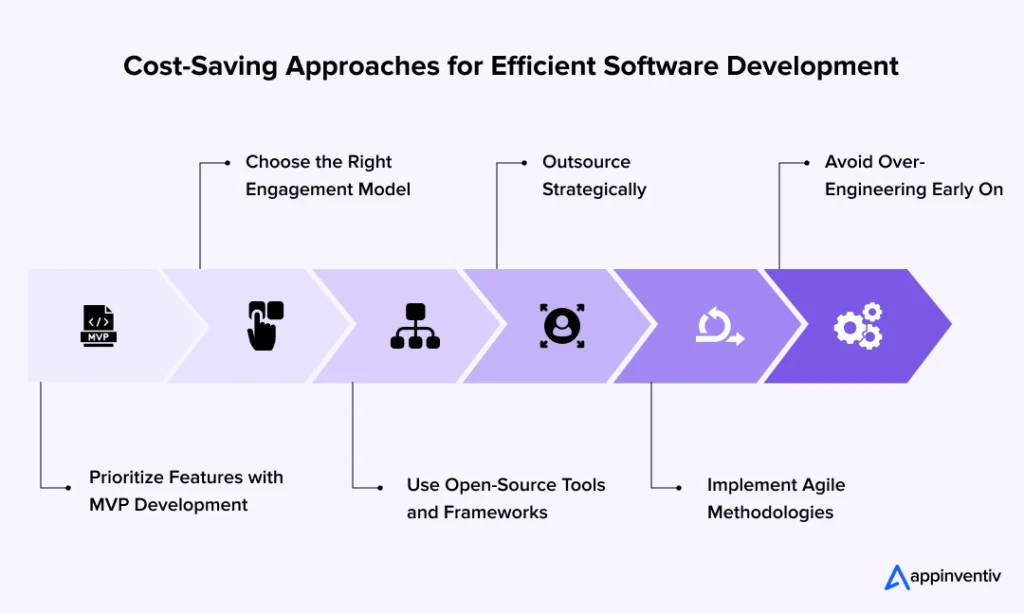

Legal Service Model & Overheads

Traditional solicitors with large offices and many staff may have higher fees. Online or specialist conveyancing providers often keep costs down and pass savings to you.

Disbursements and Fixed Fee Structure

Some quotes look low but exclude disbursements (title copies, land registry, redemption statements) or lender panel surcharges. The best cheap remortgage conveyancing quotes are fixed-fee and include these or make them transparent.

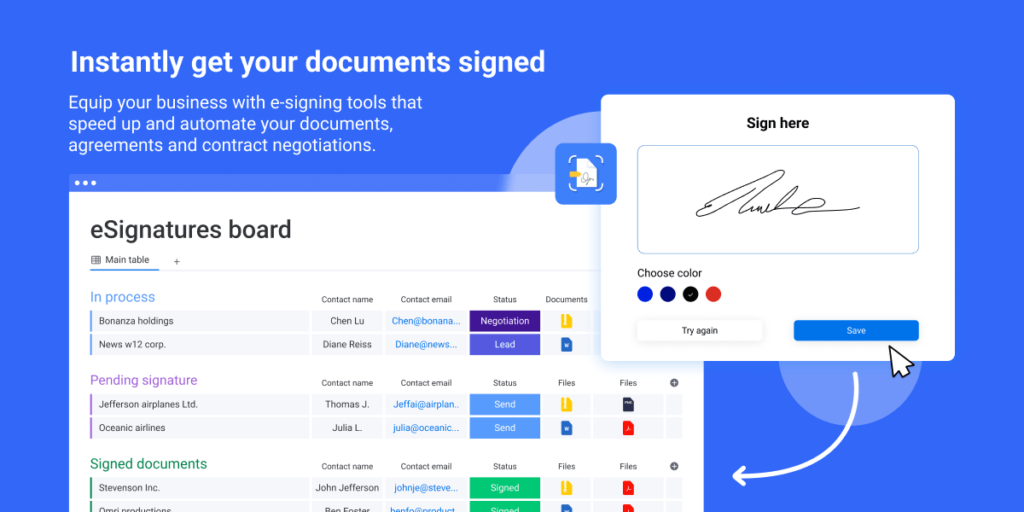

Technology and Efficiency

Use of digital portals, e-signatures, client dashboard, and automated workflow reduces manual time and overhead, meaning the provider can offer lower fees while still providing strong service.

How to Choose Reliable Cheap Remortgage Conveyancing

Get Multiple Quotes

Don’t just take the first quote. Compare several providers: legal fee, disbursements, turnaround estimate, service details.

Check Inclusivity

Ensure the quote covers essential steps for remortgage conveyancing: title verification, redemption of existing mortgage, and registration of the new lender’s charge. Make sure extra cost areas (e.g., leasehold issues) are clearly stated.

Evaluate Credentials & Panel Status

Make sure the firm is regulated and approved by your new lender’s panel (the lender often requires a panel conveyancer).

Look for Technology Indicators

If a provider offers an online status portal, e-signatures, transparent quote calculator, they likely operate efficiently and can offer lower fees.

Balance Cost and Fit

A “cheap” fee is good, but make sure the provider is a good fit for your specific remortgage scenario. If you have complexities, the cheapest option might cost you in delays.

Five Real-World Platforms/Tools for Cost-Effective Remortgage Conveyancing

Here are five tools/platforms used by conveyancing firms (and accessible in some cases by clients) that support cost-effective remortgage conveyancing. Each one described with details, benefit,, and use cases.

Conveyancing and Property Law (E‑book/Training)

Description: This is an educational product rather than a software tool: a detailed resource on conveyancing and property law, useful if you want to understand what your conveyancer does (and why things cost what they cost).

Benefits:

-

Gives you knowledge and understanding, so when you compare quotes, you know what to look for.

-

Helps you identify unnecessary cost items or ensure significant items are included.

Use case: Suppose you are remortgaging and want to question your solicitor on what exactly is included. With this resource, you are better informed.

Why you might use it: While not a cost-saver directly, it empowers you to choose the right service and avoid overpaying.

Where to “buy”: It’s available as an e-book/training resource search on specialist legal training sites.

ChatPDF Plus – PDF Analysis Software

Description: A software tool that helps you read and analyze PDF documents quickly (e.g., legal documents, remortgage offers, terms).

Benefits:

-

Speeds up your review of solicitor/ lender documents, making it less likely you miss hidden cost items.

-

Helps ensure the quote you accept truly covers what you need.

Use case: You receive a quote with many pages of terms. Using ChatP, DF, you quickly search for terms like “disbursements”, “fixed fee”, “additional costs”, helping you compare clearly.

Why you might use it: It enhances your due diligence, which contributes to cost-effective decision-making (helping ensure the “cheap” service is still appropriate).

Where to buy: Online licensing via the vendor’s site or app store.

Software Aplikasi Koperasi V4.0

Description: This is a generic example of cooperative software, not directly conveying related, but included here to illustrate how software adoption supports lower cost models.

Benefits:

-

By analogy: When providers use software tools (for workflows, admin, document management), their overheads drop, so the remortgage conveyancing fee can be lower.

-

As a homeowner, knowing that your chosen provider uses software gives you confidence.

Use case: When you ask your conveyancer, er, “Do you use case-management software or portals?” and they say yes, you can reason that they may be able to offer cheaper services.

Why you might care: It’s about recognizing the mechanism behind low-cost models.

Where to buy: Not needed for you, but used by firms; as a client, you ask about the provider’s tools.

Software Apotek Pro

Description: Though this is actually pharmacy software, it again represents the idea of leveraging specialized software to cut down overhead and cost.

Benefits:

-

Illustrates how digitization = cost savings.

-

You can use the analogy when discussing with your conveyancer: are you using specialized software for remortgage cases?

Use case: If your conveyancer indicates they rely on manual processes, you might negotiate or look elsewhere for cheaper performance.

Why you might reference it: To reinforce why some remortgage conveyancers can offer lower fixed fees, they use tech.

Where to buy: N/A for you, but as part of your conveyancer’s toolbox.

Ihs Questor 2023

Description: Another software example shows the concept of keeping up with tech to reduce cost.

Benefits:

-

Helps you understand that the cheapest remortgage conveyancing providers are usually those who invest in efficient systems.

-

Gives you a benchmark: when choosing a provider, ask them about their systems.

Use case: When comparing providers, you might ask: “What case-management software do you use for remortgages?” A provider using advanced tools is likely to offer better value.

Why do you want this? To choose a provider who uses technology, so your service is cheaper and smoother.

Where to buy: Again, illustrative rather than direct need for you.

The Benefits of Using Technology and Efficient Workflow for Cheap Remortgage Conveyancing

Lower Costs via Automation

Conveyancers using digital workflows (client portals, e-signatures, online case tracking) significantly reduce manual time, paperwork, and duplication. This allows them to pass on savings to you via lower fees.

Faster Turnarounds and Fewer Delays

Technology speeds up the process: redemption statements, lender communications, and Land Registry filings, if managed online, reduce delay/time costs. For you as a client, a faster remortgage means you switch more quickly, lock in better rates, and reduce the risk of rate rises.

Transparent Pricing and Fixed Fees

With efficient workflow, firms can operate on fixed-fee models because they accurately predict costs. This means for you, the “cheap remortgage conveyancing” quote is predictable, no nasty surprises.

Enhanced Communication and Control

With the client port, you can also see progress, upload documents, and receive alerts. This reduces friction and administrative cost, meaning the provider can maintain lower fees while maintaining service.

What Problems Cheap Remortgage Conveyancing Solves and Why You Need It

Problem: High Legal Fees

When remortgaging, you are already paying for the mortgage product; adding high legal fees reduces the benefit. Cheap remortgage conveyancing means you keep more of your savings.

Problem: Hidden or Unclear Costs

Many clients worry about hidden costs or variable fees. A low-cost provider that gives a fixed, transparent quote solves that problem, making budgeting easier and risk lower.

Problem: Slow or Poor Service During Remortgage

Time is often of the essence when remortgaging (lock-in periods ending, switching rates, etc). Cheap but efficient conveyancing via digital tools removes delays and gives you a smoother process.

Problem: Paying Premium for Service You Don’t Need

If your remortgage is straightforward, you don’t necessarily need the most expensive law firm with heavy overhead. A cost-effective solicitor who handles remortgages regularly and uses good systems is often more appropriate. This is exactly what cheap remortgage conveyancing means: right service, right price.

How to Buy and Where to Get Cheap Remortgage Conveyancing Services

Step-by-Step

-

Determine your remortgage scenario: Are you switching lenders, staying with the same lender, releasing equity, or changing property ownership? This affects complexity.

-

Request at least 3-5 quotes from conveyancing firms describing your specific scenario (remortgage with a new lender or the same lender).

-

Compare each quote: legal fee, disbursements, estimated timescale, online portal or not, fixed fee status, lender panel status.

-

Ask questions: Are you approved by my new lender’s panel? What technology do you use? Is the fee fixed or could it increase? Could there be delays/costs if there are title issues?

-

Choose the provider that gives the best value (balance of cost + service + appropriateness for your case).

-

Once instructed, ensure you engage the provider early, submit documents quickly, respond promptly, and use the online system if available to keep costs and time minimal.

Where to Buy/Find

-

Use online comparison tools for remortgage conveyancing. For example, platforms that enable instant online fixed-fee quotes.

-

Visit conveyancing firms that advertise “fixed-fee remortgage conveyancing”, “cheap remortgage conveyancing”, “remortgage solicitors fixed fee”.

-

Ask your mortgage broker; they often have recommended conveyancing partners offering lower legal fees for remortgage cases.

-

Check review sites and regulatory registration (SRA, CLC) to ensure quality.

Affiliate-style CTA Button:

Get Your Cheap Remortgage Conveyancing Quote Now

Why You Need the Cheapest Suitable Conveyancing When Remortgaging

When you remortgage, you’re often doing so to save money (better rate) or raise equity. Every pound saved on legal fees further increases the financial benefit of your remortgage. But you still need the conveyancing to be done correctly; mistakes can delay the switch, cost more in interest, or even jeopardize our deal.

By choosing cheap remortgage conveyancing that is still regulated, experienced, efficient, and transparent, you get the best of both worlds: cost savings + performance.

Final Thoughts

Cheap remortgage conveyancing doesn’t mean you sacrifice quality; it means you find the right provider who uses efficient systems, gives a fixed, transparent fee, knows how to handle remortgage transactions, and offers good value. By comparing quotes, checking services, asking about techno, l gy, and panel status, you can make an informed decision and save money as you switch your mortgage.

When you approach remortgaging this way smartly, withinformation’llyou’ll not only benefit from a lower interest rate or improved terms, but also from a smoother, less costly legal process.

Frequently Asked Questions

Q1: Do I always need conveyancing when remortgaging?

A1: Not always. If you are staying with the same lender and simply transferring to a new product (a product transfer), then often no legal work by a solicitor is needed.

However, if you are moving to a new lender or changing ownership/charge of the property, you will require conveyancing for your remortgage.

Q2: What is a realistic cost for remortgage conveyancing?

A2: The cost depends on the property, complexity, location, and lender. For straightforward remortgaging, some firms offer fixed-fee quotes (legal fees) which may compare favourably to purchase conveyancing fees. Always check what’s included (disbursements, title issues, multiple charges).

Q3: Why is using a technology-efficient conveyancer important for remortgage?

A3: A conveyancer using digital tools like client portals, automated workflows, e-signatures,s an,d online status tracking reduces manual labor and delays. That often means lower costs for you, fewer surprises, and a quicker remortgage process.