Is an Appraisal Needed for a HELOC? Complete Homeowner Guide

A Home Equity Line of Credit (HELOC) can be a smart way to access the equity in your home without refinancing your mortgage. But one big question every homeowner faces before applying is: Is an appraisal needed for a HELOC?

The answer is usually yes, but not always. In this guide, we’ll explore when a HELOC requires an appraisal, why lenders ask for it, its benefits, and how to prepare. You’ll also see real examples of major HELOC lenders, what their processes look like, and how to apply easily.

Why an Appraisal Is Usually Needed for a HELOC

A HELOC allows you to borrow against your home’s available equity, the difference between what your home is worth and what you still owe on your mortgage. Because your house serves as collateral, lenders need to verify its value before extending credit.

That’s where the appraisal comes in. An appraisal confirms the current market value of your home, allowing the lender to determine how much you can safely borrow. Without one, the lender has no reliable way to measure your equity or manage the lending risk.

In most cases, lenders use the appraisal to calculate your loan-to-value (LTV) ratio. Typically, homeowners can borrow up to 80–85% of the appraised value of the home, minus any outstanding mortgage balance.

How a HELOC Appraisal Works

When you apply for a HELOC, your lender will order an appraisal to assess your home’s value. This step usually occurs after your initial application review and credit check.

The Appraisal Process

-

Property Review – The appraiser visits your property to examine its condition, layout, and upgrades.

-

Comparable Market Analysis – They compare your home to similar recently sold properties in your neighborhood.

-

Valuation Report – A detailed report is created, summarizing your home’s estimated market value.

-

Lender Review – Your lender uses this report to calculate your eligible credit limit.

This process ensures that both you and your lender understand exactly how much equity is available and what borrowing limit is safe.

How Long Does It Take

A standard appraisal usually takes about one to two weeks, depending on local demand and property complexity. However, some lenders now use automated systems to shorten this timeline to just a few days.

When an Appraisal May Not Be Required

While most HELOCs require an appraisal, there are exceptions. Some lenders use Automated Valuation Models (AVMs), advanced software that estimates home values based on market data, recent sales, and property records.

You might not need a full in-person appraisal if:

-

Your loan amount is relatively small.

-

You have excellent credit and low debt.

-

You recently had an appraisal within the last 12 months.

-

Your property is located in an area with reliable housing data.

In such cases, the lender might conduct a “desktop appraisal” or “drive-by appraisal,” which uses public records and photos instead of an interior inspection.

The result is a faster, lower-cost process, though it might limit how much you can borrow.

Benefits of the HELOC Appraisal Requirement

Ensures Accurate Home Valuation

An appraisal provides an independent, professional estimate of your home’s true worth. This protects both you and the lender from inaccurate valuations and overborrowing.

Increases Borrowing Confidence

A verified appraisal means you know exactly how much equity you have, which can help you plan renovations, debt consolidation, or large expenses with confidence.

Better Loan Terms

When your appraisal reflects a strong property value, you may qualify for a larger credit limit, better rates, and more flexible repayment terms.

Faster Loan Approval (with Modern Technology)

Many lenders now combine digital data with streamlined appraisal models, reducing delays and letting homeowners access funds quickly.

Real-World HELOC Lenders and Their Appraisal Policies

Below are five trusted HELOC products that illustrate how the appraisal process is handled and what you can expect when applying.

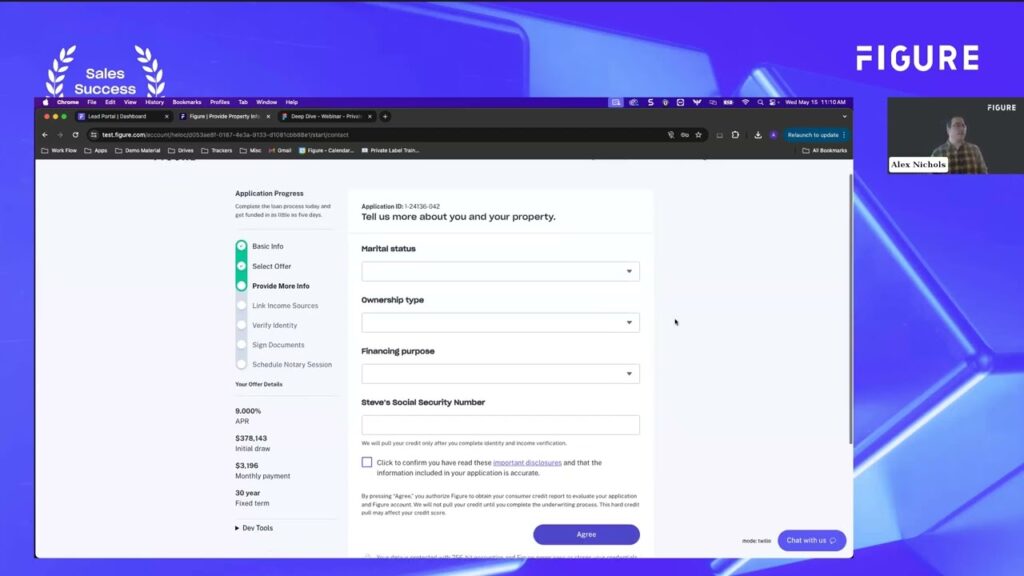

1. Figure Home Equity Line

Details:

Figure offers a fast, fully online HELOC with funding in as little as five days. They often use automated valuations instead of in-person appraisals, making the process faster and easier.

Benefits:

-

Quick approval and funding.

-

Minimal paperwork.

-

Lower upfront cost since no full appraisal is needed.

Use Case:

Perfect for homeowners with solid equity who need cash quickly without waiting for a traditional appraisal.

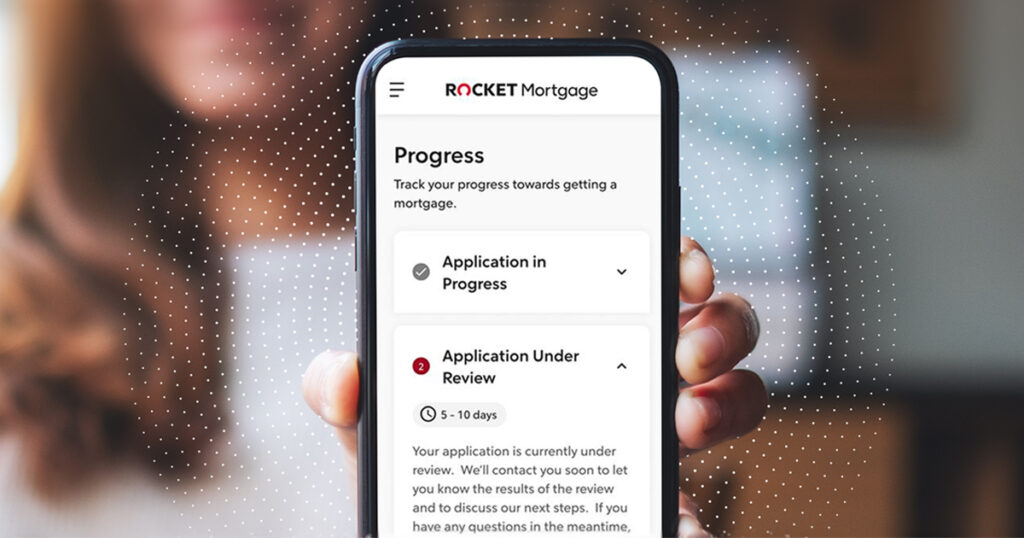

2. Rocket Mortgage Home Equity Loan

Details:

Rocket Mortgage typically requires a full appraisal for home equity loans and HELOCs to ensure accuracy. The process is handled by licensed professionals and usually takes 1–2 weeks.

Benefits:

-

High borrowing limits due to verified appraisals.

-

Reliable value assessment.

-

Trusted national lender.

Use Case:

Ideal for homeowners seeking a large credit line or refinancing with long-term stability.

3. Discover Home Equity Loan

Details:

Discover typically includes a professional appraisal as part of its home equity loan process. Their transparent approach ensures your home’s value is fully verified before approval.

Benefits:

-

Transparent process with fixed-rate options.

-

Competitive interest rates.

-

Trusted, customer-focused lender.

Use Case:

Great for homeowners who prefer traditional lending backed by complete valuation accuracy.

Chase HELOC

Details:

Chase Bank requires a home appraisal for most HELOC applications, especially when borrowing higher amounts. They use certified appraisers and provide detailed valuation reports.

Benefits:

-

Comprehensive appraisal process.

-

High maximum borrowing potential.

-

Reputable, large-scale financial institution.

Use Case:

Best for borrowers seeking a large HELOC or refinancing their mortgage and line of credit together.

Point Home Equity

Details:

Point provides alternative home equity options, often using hybrid appraisals that combine digital analysis with physical verification.

Benefits:

-

Quicker valuations for faster approvals.

-

Flexible funding based on partial home equity sharing.

-

Simplified application process.

Use Case:

Ideal for homeowners who want cash-out equity solutions without taking on traditional debt.

How to Prepare for a HELOC Appraisal

Improve Your Home’s Presentation

First impressions matter. Clean up clutter, fix small repairs, and improve curb appeal. A fresh coat of paint, trimmed yard, and working light fixtures can influence perceived value.

Document Recent Upgrades

Provide records of home improvements such as a new roof, HVAC system, or remodels. This can increase your appraised value by highlighting added features.

Research Local Market Trends

Know what similar homes in your area have recently sold for. Appraisers often use comparable properties, and being informed helps you understand potential valuation outcomes.

Be Present and Proactive

Attend the appraisal if allowed. Be prepared to answer questions and point out details the appraiser might miss, like new windows or energy-efficient appliances.

Review the Report Carefully

After the appraisal, review the report for accuracy. If you spot errors or omissions, you can request a reassessment.

Common Problems with HELOC Appraisals and How to Fix Them

Low Appraisal Values

If your appraisal comes in lower than expected, don’t panic. You can request a second opinion or provide evidence of home improvements not included in the report.

Market Volatility

Housing markets fluctuate. If your neighborhood is seeing rapid price changes, timing your appraisal strategically can yield better results.

Property Condition Issues

Deferred maintenance or visible damage can lower your appraisal value. Consider small repairs before scheduling the appraisal to avoid deductions.

Why Homeowners Benefit from Understanding Appraisal Requirements

When you understand whether an appraisal is needed for a HELOC, you gain several advantages:

-

You can choose the right lender – Some use AVMs, while others require full inspections.

-

You’ll avoid surprises – Knowing the process prevents last-minute costs or delays.

-

You’ll maximize your home’s value – Proper preparation can boost appraisal results.

-

You’ll borrow responsibly – Understanding your real equity keeps your finances balanced.

Frequently Asked Questions

Q1: Is an appraisal always required for a HELOC?

Not always. Most lenders require it, but some offer appraisal-free HELOCs using digital valuation tools. Whether you need one depends on your loan size, equity, and lender policy.

Q2: How much does a HELOC appraisal cost?

Appraisals typically cost between $300 and $800, depending on the property type, size, and location. Some lenders include this cost in closing fees.

Q3: How can I increase my home’s appraised value?

Focus on maintenance and presentation. Complete small repairs, improve curb appeal, and keep records of recent upgrades. Clean, organized spaces create better impressions and may raise the valuation.

Final Thoughts

So, is an appraisal needed for a HELOC? In most cases, yes, because lenders need to confirm your home’s value before granting credit. However, thanks to new technology and data-driven valuation models, some lenders now skip full appraisals for qualified borrowers.

Understanding this process not only saves time but also ensures you make informed financial decisions. By preparing your home, choosing the right lender, and knowing what to expect, you can secure your HELOC quickly and confidently.